The gig economy continues to grow, but many freelancers and side hustlers are caught off-guard when tax season hits. From Uber drivers to freelance designers, anyone earning income outside...

No one wants a letter from the IRS. While most audits are random, many are triggered by red flags on your return. As a business owner, freelancer, or high-income...

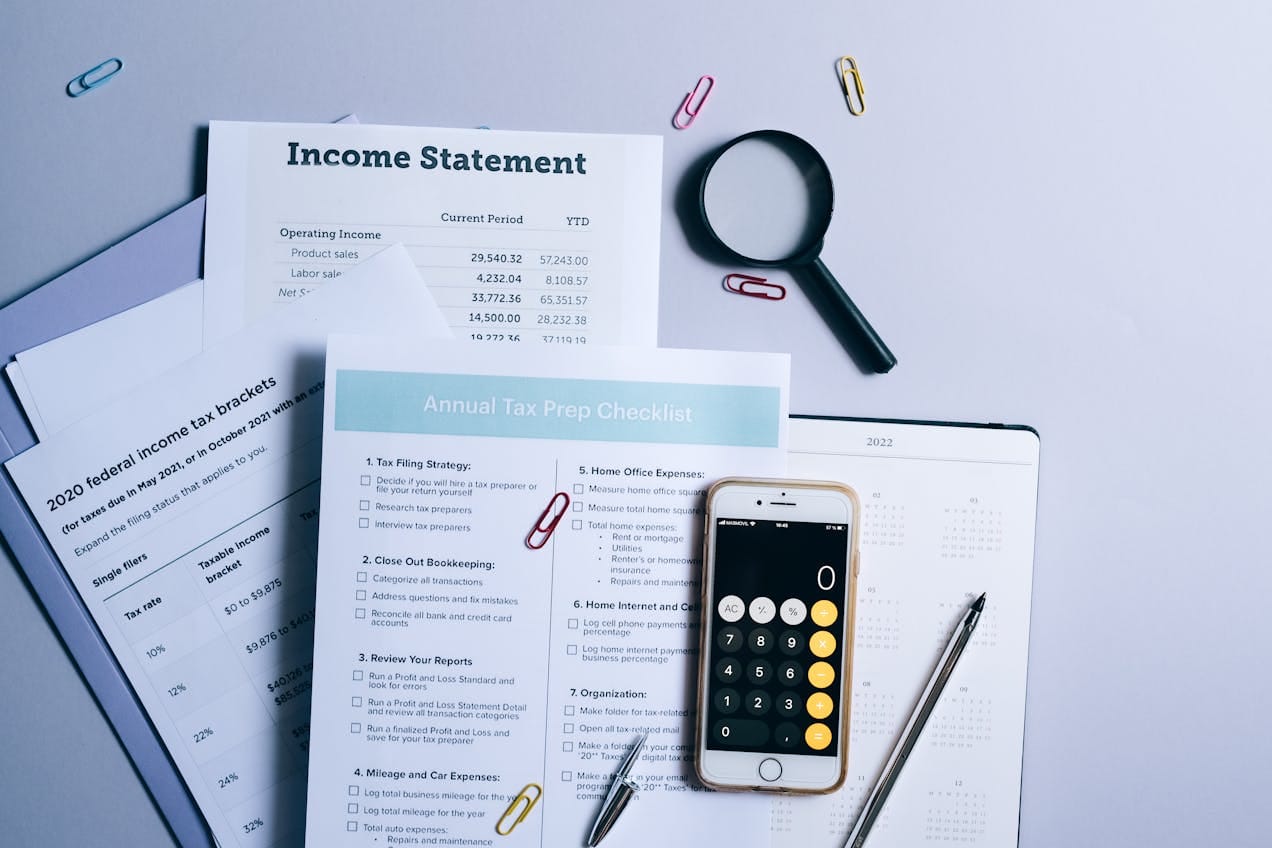

Business Taxes Before Year-End Business owners often find themselves racing against the clock at year-end, grappling with mounting tax liabilities that erode profits and constrain growth. Inexperienced tax preparers...

Introduction Business owners and self-employed professionals often grapple with high tax burdens, missing out on significant deductions due to complex tax codes and inexperienced advisors. The Qualified Business Income...

Introduction Dental practice owners operating as S corporations often grapple with the challenge of balancing compensation structures to minimize tax liabilities while complying with IRS mandates on reasonable salary....

Introduction Attorneys and law firm owners often contend with intricate tax landscapes, where pass-through income from partnerships or S corporations can lead to substantial tax liabilities if not optimized...

Introduction High-net-worth individuals and business owners often face a daunting challenge: navigating a labyrinth of tax laws to protect their wealth. Inexperienced CPAs may miss sophisticated strategies, leading to...

Introduction If your Shopify store (and eBay integration) is racking up hundreds of thousands in annual sales, basic tax compliance won’t cut it. High-volume sellers face unique planning opportunities...

Self-employment tax is often one of the largest tax obligations for freelancers, consultants, and small business owners. Fortunately, the Internal Revenue Code (IRC) provides several ways to legally minimize...

Startup Cost Deduction When starting a new business, many costs are incurred even before operations officially begin. Fortunately, the IRS allows business owners to deduct startup costs under specific...