BusinessHeadache-free payroll solutions

Let Kewal Krishan & Co, Chartered Accountants provide you with an unmatched employee benefits plan that saves you time and gives you accountability.With our help, you can minimize costly and time-consuming tax liabilities. Get the peace of mind you need to focus on your business!

Don't worry about skimpy budgeting or arcane rules – we make it a breeze to pay all the right taxes quickly and easily.

Our streamlined data entry process helps you keep your books up-to-date and accurate, saving time and hassle.

You are free to take it easy and not worry about whether or not your taxes meet the requirements of the IRS.

Get the best possible outcomes for your organization with us.

Minimize your company’s expenses and quantify visible costs with structured payroll services. No matter what your business functions into, it is your job to keep your employees satisfied with accuracy and compliance according to industry standards. A comprehensive payroll set-up supports the organization’s pay policy for leave encashments, allowances, and overtime, keeping tax-saving components in mind.

Let Kewal Krishan & Co, Chartered Accountants provide you with an unmatched employee benefits plan that saves you time and gives you accountability.

Our Core Services

Checks or Direct Deposit for Your Employees

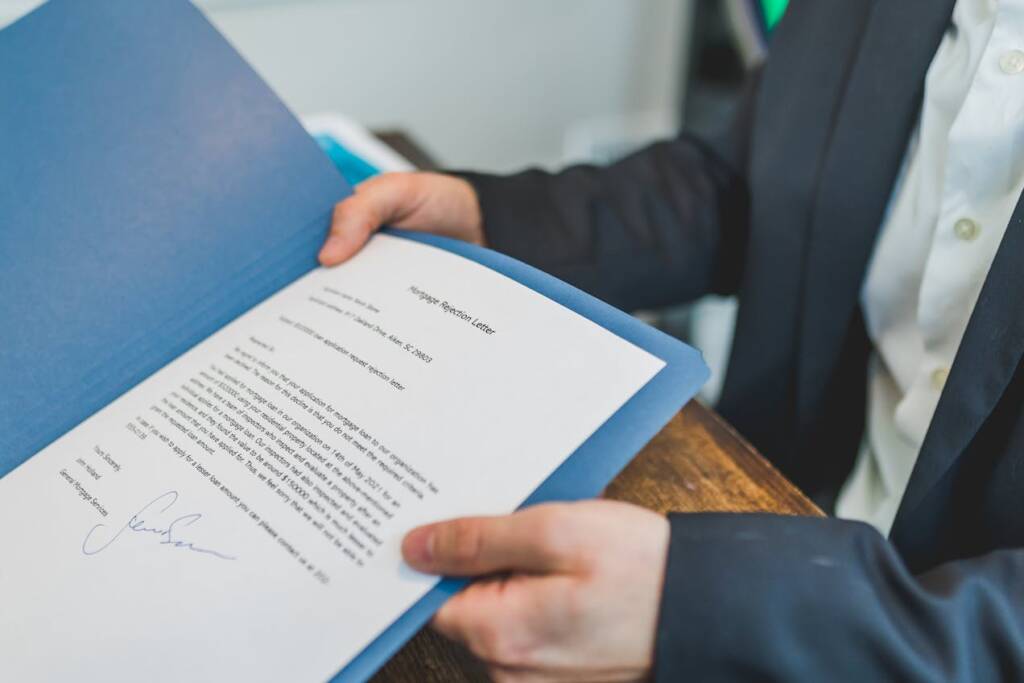

Federal Tax Liabilities

State & Local Tax Liabilities

Unemployment Tax Liabilities

Quarterly Tax Forms

Year-End Tax Forms

Customized Payroll Reports

Tax Deposit Services

W-2s and 1099s

Multiple Employee Pay Options

Improving payroll Accuracy

Save Time on Data Entry

Employee Self- service

Compliance Support

We Provide Services in Following Countries

Latest blog posts

- 10 Aug 2024

Common Mistakes to Avoid When Applying for an IRS Tax ID from Abroad

Are you a U.S. resident living abroad and finding it difficult to obtain your IRS...

- 09 Aug 2024

Consequences of Missing UK Corporate Tax and Annual Report Deadlines

Did you know that missing UK corporate tax and annual report deadlines can result in...

- 09 Aug 2024

Taxation of US LLC in Delaware Owned by Indian Citizens: A Comprehensive Guide

Introduction As an Indian citizen, forming a US Limited Liability Company (LLC) in Delaware can...

- 08 Aug 2024

Staying Compliant with UK Corporate Tax Filing Requirements

Are you aware that non-compliance with UK corporate tax filing requirements can lead to severe...

- 08 Aug 2024

UK Corporate Tax Deadlines: Essential Dates and What to File

Your Guide to UK Corporate Tax Obligations: A Must-Read for US Expats and Business Owners!...

- 07 Aug 2024

Filing UK Corporate Annual Reports: Key Deadlines and Requirements

Did you know that failing to file your UK corporate annual report on time can...

Firm Brochure

Know more about our firm executives, international tax practice and core services aligning our selves with the ever dynamic out paced competitive world.