Introduction Subscription box businesses on Shopify have exploded in popularity – from beauty to snacks to niche hobbies. Before you curate your first box, you need the right legal...

Eco Brands Eco-friendly brands are on the rise – and with sustainability comes unique tax opportunities. From energy credits to accelerated depreciation on green equipment, 2025 offers powerful incentives...

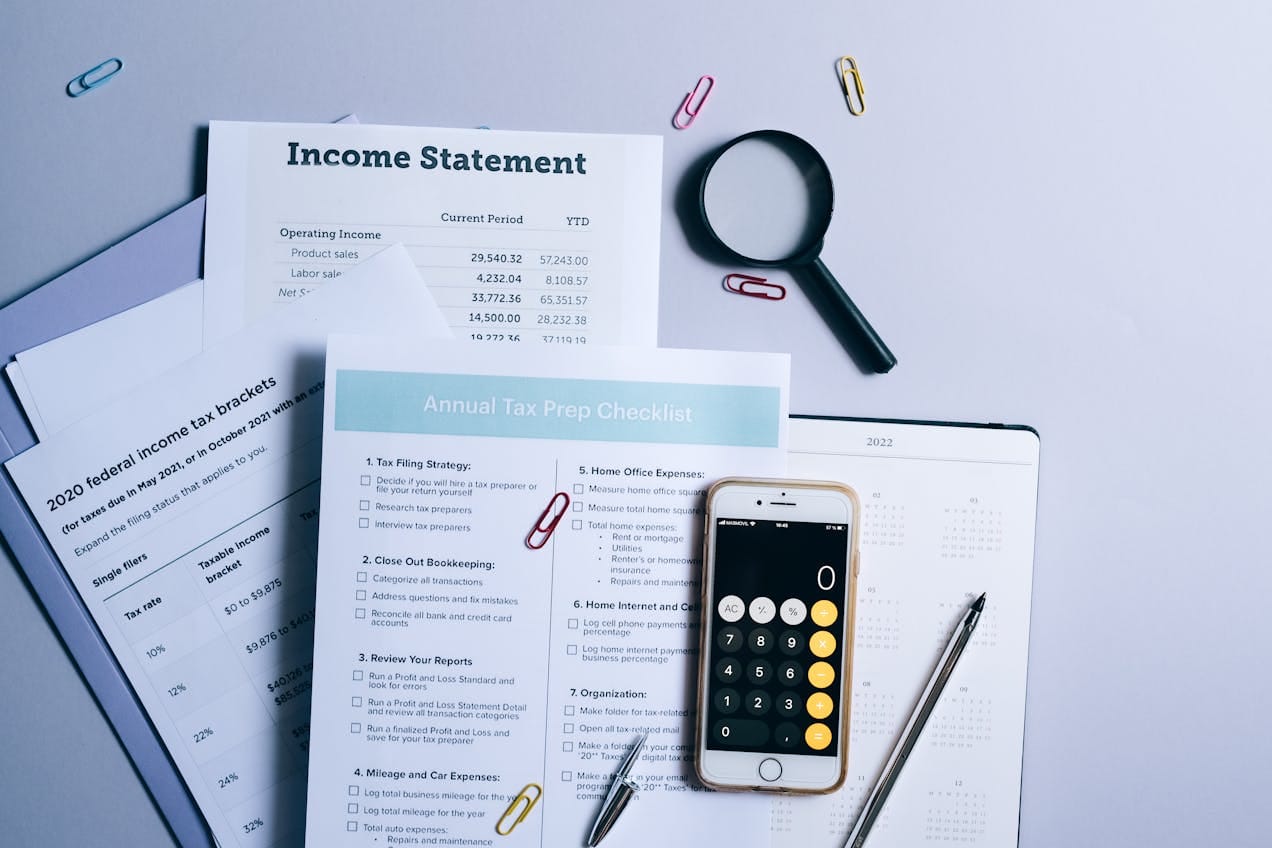

Pass-through entities sole proprietorships, partnerships, S-corps, and LLCs can benefit from an automatic six-month extension, but only if you handle estimated taxes, Form 8995 QBI worksheets, and timing properly....

Self-employment tax is a major part of a self-employed individual’s IRS obligations. It includes Social Security and Medicare taxes that would otherwise be withheld from an employee’s paycheck. If...

Self-employment tax is often one of the largest tax obligations for freelancers, consultants, and small business owners. Fortunately, the Internal Revenue Code (IRC) provides several ways to legally minimize...

If you are self-employed, an independent contractor, freelancer, or have significant income without tax withholding, the IRS generally requires you to make quarterly estimated tax payments. Failure to do...

Delaware Franchise Tax Delaware’s Annual Report and Franchise Tax are due June 1 each year without a statutory extension. If you miss this deadline, you face penalties, interest, and...

The Qualified Business Income (QBI) deduction allows many business owners to deduct up to 20% of their business income on their personal tax return, significantly reducing federal income taxes....

IRS Tax Extension Filing on time isn’t always possible. Fortunately, the IRS grants an automatic six-month extension for most returns from individual (Form 4868) to corporate (Form 7004). But...

Introduction Many Shopify POS (Point of Sale) users run successful in-person retail businesses. But in 2025, more local brands are expanding to Amazon to capture nationwide audiences. If you’re...