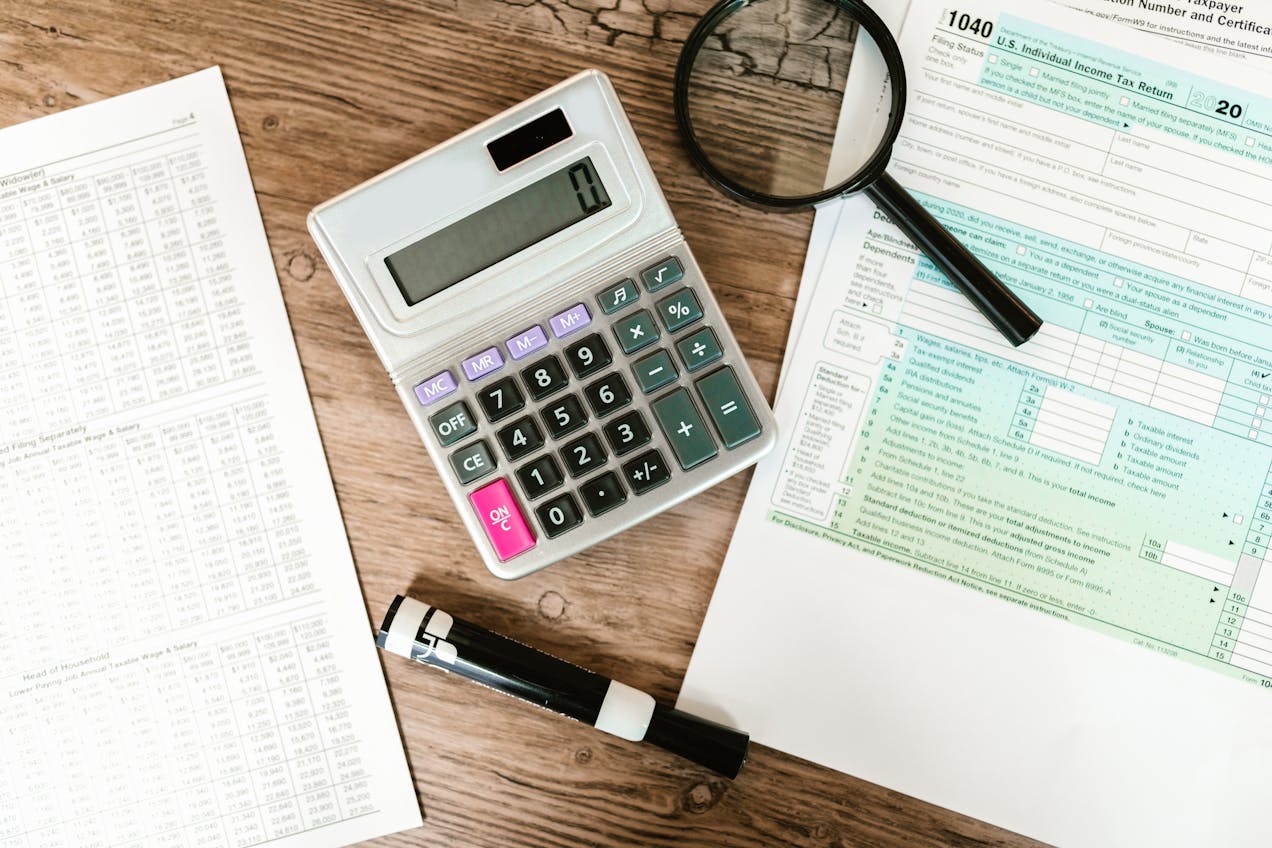

Introduction The IRS Free File Program allows eligible taxpayers to file their federal tax returns for free using IRS-approved tax software. For 2025, the IRS has expanded eligibility and...

Introduction The Inflation Reduction Act (IRA), signed into law in 2022, introduced significant tax provisions that impact individuals, businesses, and self-employed taxpayers. In 2025, several key provisions continue to...

Introduction The IRS standard deduction is a key tax benefit that reduces taxable income, lowering the amount of taxes owed. Each year, the IRS adjusts the standard deduction to...

Introduction Many taxpayers miss out on valuable deductions simply because they don’t know they exist. The IRS tax code allows for several deductions that can reduce taxable income, but...

Introduction Legal fees can be expensive, but some may be tax-deductible if they meet IRS guidelines. The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated most personal legal...

Introduction The Child Tax Credit (CTC) is a valuable tax benefit for families with dependent children, helping to reduce tax liability and, in some cases, provide a refund. The...

Introduction Small business owners and self-employed individuals often use their vehicles for work-related purposes. The IRS allows deductions for business-related car expenses, but specific rules apply. You can choose...

Introduction Homeowners who invest in energy-efficient upgrades can qualify for valuable tax credits, helping them save money while reducing their carbon footprint. The IRS offers two main energy tax...

Introduction Business travel can be a significant expense, but the IRS allows deductions for ordinary and necessary travel costs related to your work. Whether you’re a self-employed professional, freelancer,...

Introduction Higher education can be expensive, but the IRS offers tax credits that help students and parents reduce their tax burden. The American Opportunity Tax Credit (AOTC) and the...