Self-employment tax is often one of the largest tax obligations for freelancers, consultants, and small business owners. Fortunately, the Internal Revenue Code (IRC) provides several ways to legally minimize...

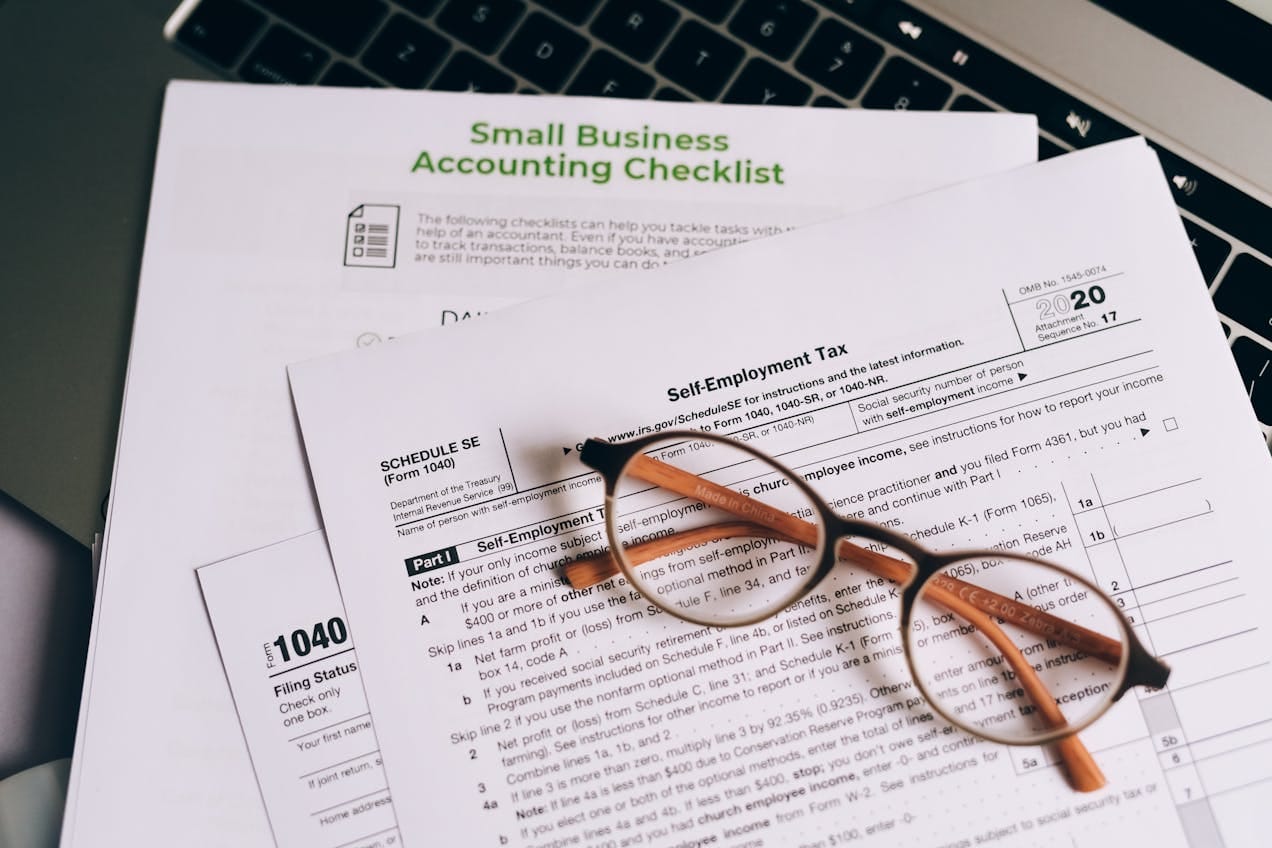

Introduction Unlike employees, independent contractors do not have taxes withheld from their payments. Instead, under IRC § 1402, they must pay self-employment tax and income tax directly to the...

Introduction The IRS requires taxpayers to pay taxes throughout the year, either through withholding or estimated tax payments. If you underpay your taxes, you may face penalties and interest...

Introduction The IRS requires tax withholding on various types of income to ensure taxes are paid throughout the year. Under IRC § 3402, employers must withhold federal income tax,...

Introduction The home office deduction allows self-employed individuals to deduct a portion of their home expenses when they use a dedicated workspace for business. According to IRC § 280A,...

Introduction As a self-employed taxpayer, you are responsible for paying self-employment tax and reporting all business income. However, the IRS allows business deductions to help reduce Adjusted Gross Income...

Introduction Freelancers and self-employed individuals must pay taxes throughout the year instead of having them withheld from a paycheck. The IRS requires freelancers to make quarterly estimated tax payments...

Introduction Reducing business taxes legally is essential for improving cash flow and increasing profitability. The IRS provides multiple tax-saving strategies, including deductions, credits, depreciation, and retirement contributions that help...

What if you could save thousands of dollars on taxes while keeping more of your hard-earned money? The S Corp election is a tax strategy designed specifically for small...

Are you a small business owner or self-employed superstar looking for a retirement plan that’s simple, flexible, and offers massive tax benefits? Meet the SEP IRA, your new best...