Introduction If you are self-employed, an independent contractor, or earn non-W-2 income, you may be required to make estimated tax payments throughout the year. Under IRC § 6654, the...

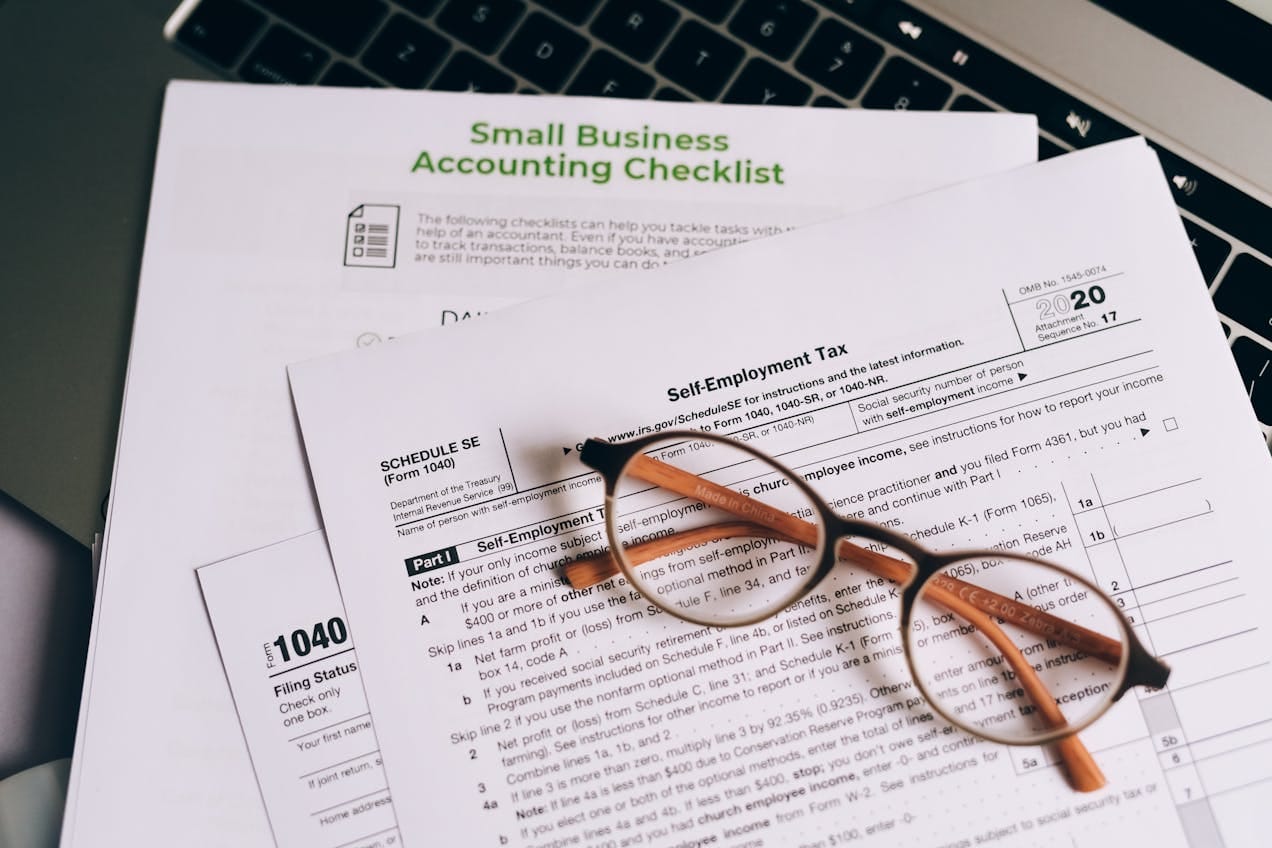

Introduction As a self-employed taxpayer, you are responsible for paying self-employment tax and reporting all business income. However, the IRS allows business deductions to help reduce Adjusted Gross Income...

Introduction Self-employed individuals face unique tax obligations, including self-employment tax, estimated quarterly payments, and business deductions. The new tax laws for 2025 bring several changes that impact freelancers, gig...

Introduction The IRS has introduced stricter reporting requirements for side hustle income in 2025, affecting freelancers, gig workers, and independent contractors. With the expansion of third-party payment reporting and...

Introduction With the rise of freelancing, gig work, and side hustles, many people earn extra income through Uber, DoorDash, Etsy, consulting, or online platforms. However, gig workers often face...

Introduction Freelancers and self-employed individuals often miss valuable tax deductions that could significantly reduce their taxable income. Unlike W-2 employees, freelancers must pay self-employment taxes and cover their own...

Introduction Freelancers and self-employed individuals must pay taxes throughout the year instead of having them withheld from a paycheck. The IRS requires freelancers to make quarterly estimated tax payments...

The Essential Guide to Keeping Your Tax Obligations in Check As a US resident living abroad, managing your tax obligations can feel overwhelming. Missing a crucial tax deadline could...

Cryptocurrency is reshaping the financial world, offering new opportunities for traders, investors, and enthusiasts alike. However, this new frontier has its challenges, particularly when it’s time to report crypto...

In the multifaceted world of U.S. taxation, self-employment tax stands out as a significant consideration for entrepreneurs, freelancers, and independent contractors. This tax, which covers contributions to Social Security...