The Unexpected Adventure: Facing an IRS Audit Abroad Imagine this: You’ve just adapted to the vibrant culture of your new overseas home, navigating through language barriers, and exploring exotic...

The US Tax Revolution: What Every American Expat Must Know in 2024 Are you an American living overseas? If so, buckle up! The U.S. tax landscape has undergone some...

Are you a US citizen living abroad, navigating the treacherous waters of tax filings and looking for a lifeline? The complexity of US tax laws can make anyone’s head...

The Dual Resident Dilemma Are you a globe-trotting individual who finds yourself both a U.S. resident and a nonresident in the same tax year? Welcome to the world of...

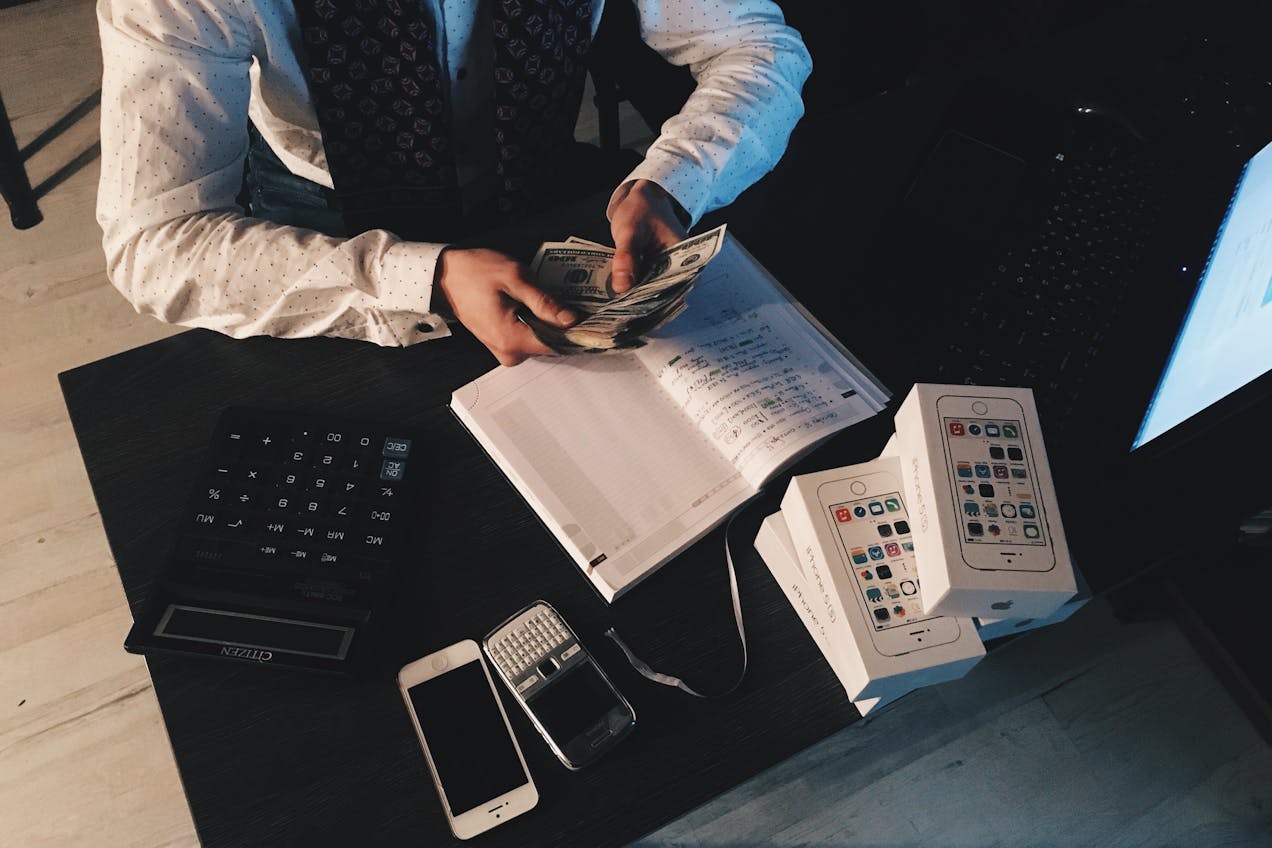

The Secret Financial Responsibility Every American Abroad Should Know Imagine this: You’re savoring the experience of living abroad, soaking in new cultures, and exploring breathtaking landscapes. Amidst this adventure,...

The Federal Tax Authority’s recent accolade from the Global InnoVATion Institute isn’t just a ceremonial title; it’s a beacon of the FTA’s forward-thinking approach to tax administration. This recognition...

California’s tax system is designed to be progressive, meaning that the rate of taxation increases as taxable income increases. This approach aims to ensure a fairer distribution of the...

Changes to previously reported informations or inaccuracies identified Stay Ahead of Changes: Keep Your BOI Report Updated! Don’t get caught off guard by changes! The Need for Timely Updates...

Welcome to the dynamic landscape of corporate taxation in the United Arab Emirates (UAE)! As one of the most sought-after business hubs in the world, the UAE has continuously...

In the fast-paced realm of cryptocurrency, where fortunes can quickly shift hands, there’s one opponent that even the most adept traders may neglect: the tax collector. As digital currencies...