Introduction Launching a product on Amazon FBA in 2025? Your success starts with smart product research. Without it, you risk investing in dead inventory, pricing yourself out of competition,...

Introduction Are you a digital creator selling globally on Amazon merch, books, print-on-demand products, or private label items? As exciting as global reach can be, returns and refunds across...

Introduction Want to hit 6 figures on eBay in 2025? Then product research isn’t optional it’s your business blueprint. What you sell, how you price it, and where you...

Introduction In 2025, e-commerce sellers are scaling faster than ever but platform suspensions are also at an all-time high. Amazon, Shopify, Etsy, Walmart, and eBay are enforcing stricter policies...

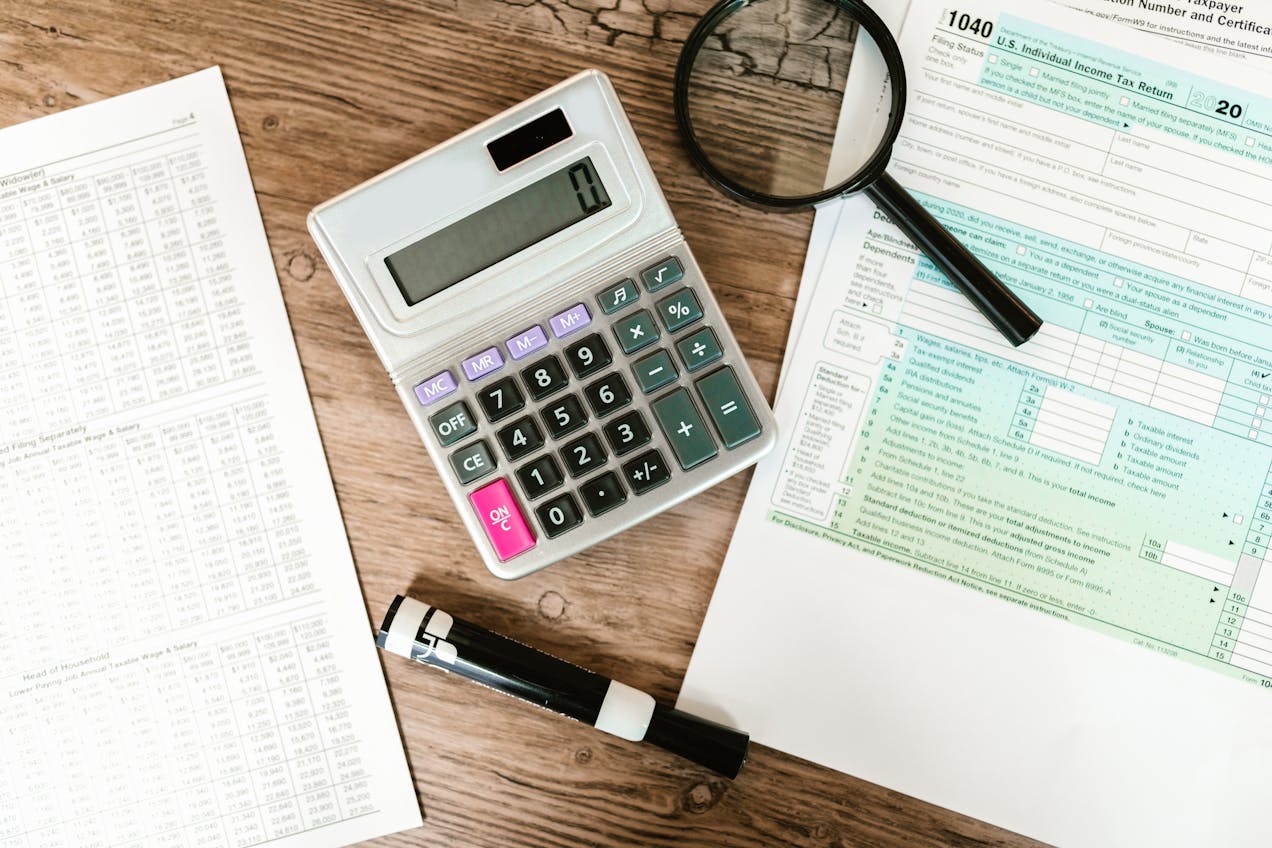

Introduction Accounting fraud occurs when financial records are manipulated to deceive stakeholders, evade taxes, or hide losses. Fraud can result in legal penalties, financial losses, and reputational damage. This...

Introduction ctivity-Based Costing (ABC) is a cost management system that helps businesses allocate overhead costs more accurately. Unlike traditional costing, which assigns costs based on direct labor or machine...

Introduction Cost accounting is a financial management tool that helps businesses track, analyze, and control costs. It provides insights into production costs, profitability, and pricing strategies, enabling businesses to...

Are you a U.S. resident living abroad and finding it difficult to obtain your IRS Tax Identification Number (TIN)? You’re not alone! Applying for a TIN from overseas can...

Are you aware that non-compliance with UK corporate tax filing requirements can lead to severe penalties and legal repercussions for your business? This blog post will equip you with...

Tax Season Alert: Essential 2024 Dates Every U.S. Expat Needs to Know! Tax obligations can be complex, especially for U.S. residents living abroad with foreign bank accounts. Missing key...