In the fast-paced U.S. restaurant industry, precise financial management is crucial. For many smaller restaurants and independently owned eateries, the cash basis of accounting offers a simple and effective...

Successfully navigating the U.S. construction industry requires a comprehensive understanding of both financial reporting standards, specifically U.S. Generally Accepted Accounting Principles (U.S. GAAP), and the complex tax codes that...

How California’s Prevailing Wage Laws Are Reshaping Construction Accounting In the labyrinth of construction regulations, California’s prevailing wage laws stand out as a pivotal factor that can make or...

In the diverse landscape of the U.S. real estate industry, selecting the right accounting method is crucial for accurate financial reporting, tax compliance, and strategic decision-making. While the accrual...

Navigating the complex landscape of sales tax within the U.S. restaurant industry requires a nuanced understanding of state-specific legislation and the overarching principles of U.S. Generally Accepted Accounting Principles...

In the construction industry, accurately and effectively managing finances is key to success. While U.S. Generally Accepted Accounting Principles (U.S. GAAP) generally favor the accrual basis of accounting for...

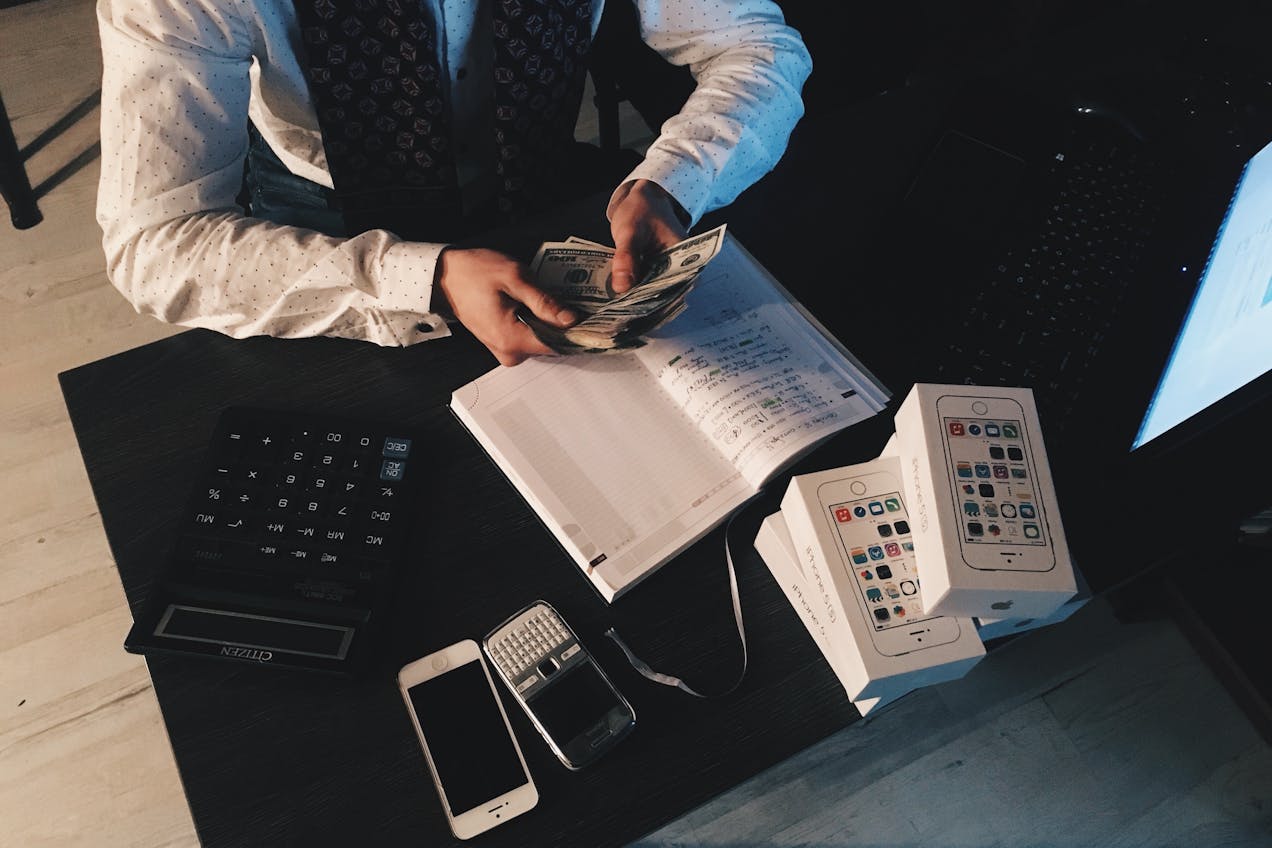

Introduction A financial audit is an in-depth review of a company’s financial statements, transactions, and records to ensure accuracy and compliance with IRS regulations, accounting standards, and industry best...

The end of the year is creeping up fast, and while you’re busy planning holiday gatherings and gift lists, don’t forget about something equally important—your taxes! Year-end compliance is...

Did you know that missing UK corporate tax and annual report deadlines can result in severe financial penalties, legal consequences, and even damage your company’s reputation? Understanding these risks...

Attention U.S. Expats: Don’t Let This Extended Tax Deadline Slip By! Are you a U.S. citizen living abroad with foreign bank accounts? If so, you might be familiar with...