Introduction The IRS 1099-K reporting rule has changed in 2025, affecting small businesses, freelancers, and gig workers who receive payments through third-party platforms like PayPal, Venmo, Square, eBay, and...

Introduction The IRS is intensifying efforts to combat tax fraud in 2025, focusing on high-income earners, cryptocurrency transactions, unreported income, and fraudulent deductions. With increased IRS funding, audit rates...

Introduction The Inflation Reduction Act (IRA), signed into law in 2022, introduced significant tax provisions that impact individuals, businesses, and self-employed taxpayers. In 2025, several key provisions continue to...

Introduction Many taxpayers miss out on valuable deductions simply because they don’t know they exist. The IRS tax code allows for several deductions that can reduce taxable income, but...

Introduction Legal fees can be expensive, but some may be tax-deductible if they meet IRS guidelines. The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated most personal legal...

Introduction Small business owners and self-employed individuals often use their vehicles for work-related purposes. The IRS allows deductions for business-related car expenses, but specific rules apply. You can choose...

Introduction Business travel can be a significant expense, but the IRS allows deductions for ordinary and necessary travel costs related to your work. Whether you’re a self-employed professional, freelancer,...

Introduction Many taxpayers miss out on valuable deductions simply because they don’t know they exist. The IRS tax code allows for several deductions that can reduce taxable income, but...

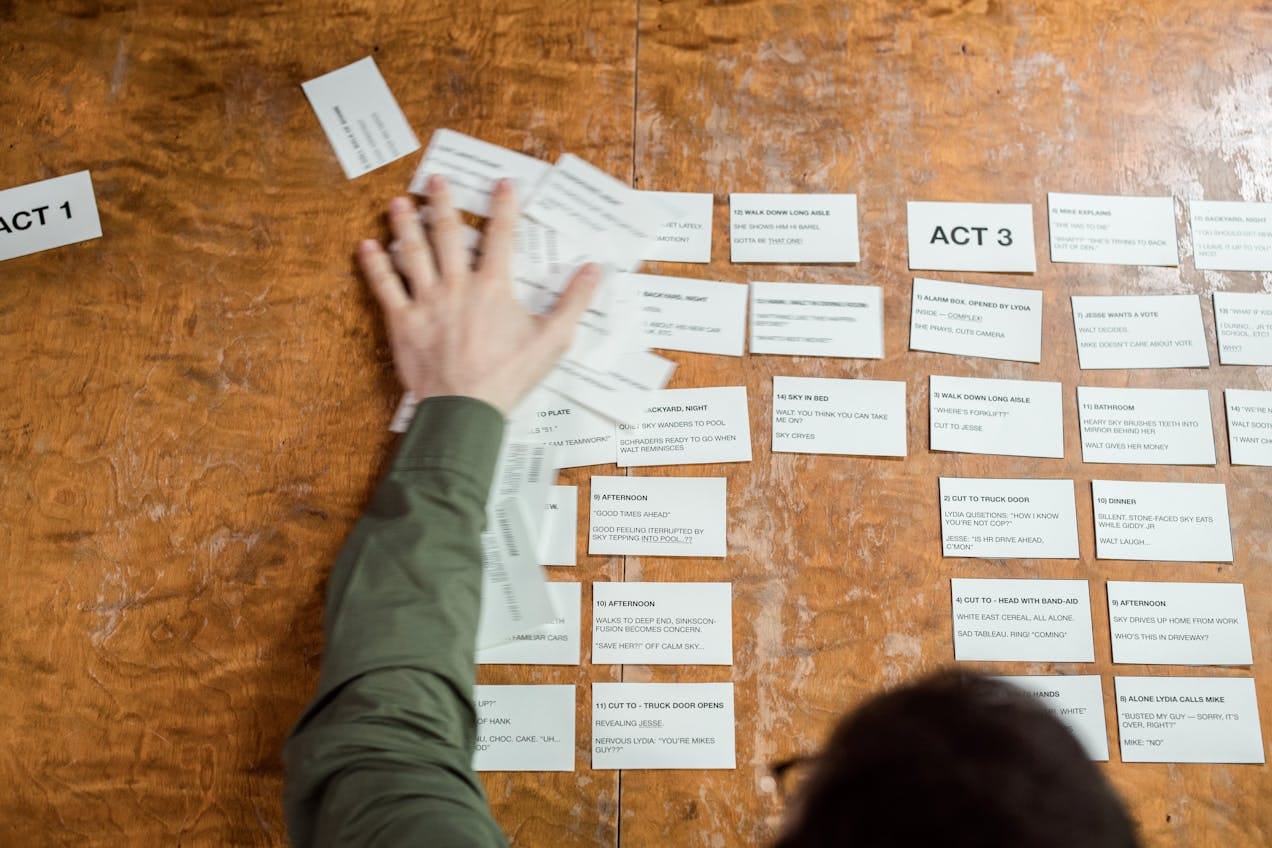

Introduction Year-end financial statements provide a summary of a company’s financial position and performance for the fiscal year. These reports are essential for tax filing, business valuation, investor reporting,...

Filing Taxes for the First Time? Here’s What You Need to Know If you’re filing taxes for the first time, you might be feeling a mix of emotions—confusion, stress,...