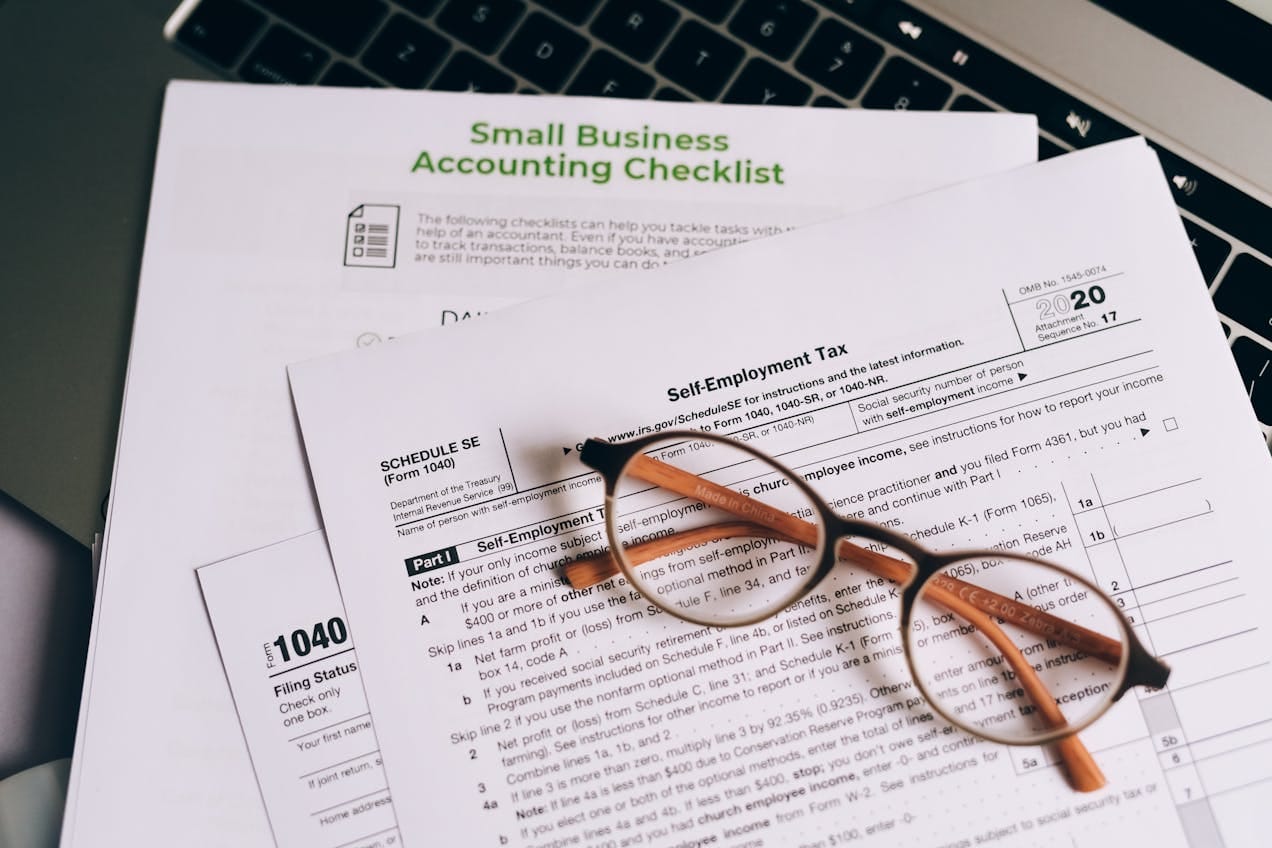

Introduction As a self-employed taxpayer, you are responsible for paying self-employment tax and reporting all business income. However, the IRS allows business deductions to help reduce Adjusted Gross Income...

Introduction Getting a larger tax refund starts with smart tax planning. Many taxpayers miss out on deductions, credits, and tax-saving strategies that could increase their refund. This guide explains...

Introduction With the rise of freelancing, gig work, and side hustles, many people earn extra income through Uber, DoorDash, Etsy, consulting, or online platforms. However, gig workers often face...

Introduction As the year comes to a close, taxpayers have limited time to take advantage of tax-saving strategies that can significantly reduce their tax liability. Whether you are an...

Introduction Freelancers and self-employed individuals often miss valuable tax deductions that could significantly reduce their taxable income. Unlike W-2 employees, freelancers must pay self-employment taxes and cover their own...