Many Indian nationals on H-1B or OPT status working in the U.S. start freelancing or consulting to earn side income. What they don’t realize is that this could violate...

Need a Financial Plan A great business idea can get you started, but a solid financial plan keeps you going. As an entrepreneur, your success doesn’t just hinge on...

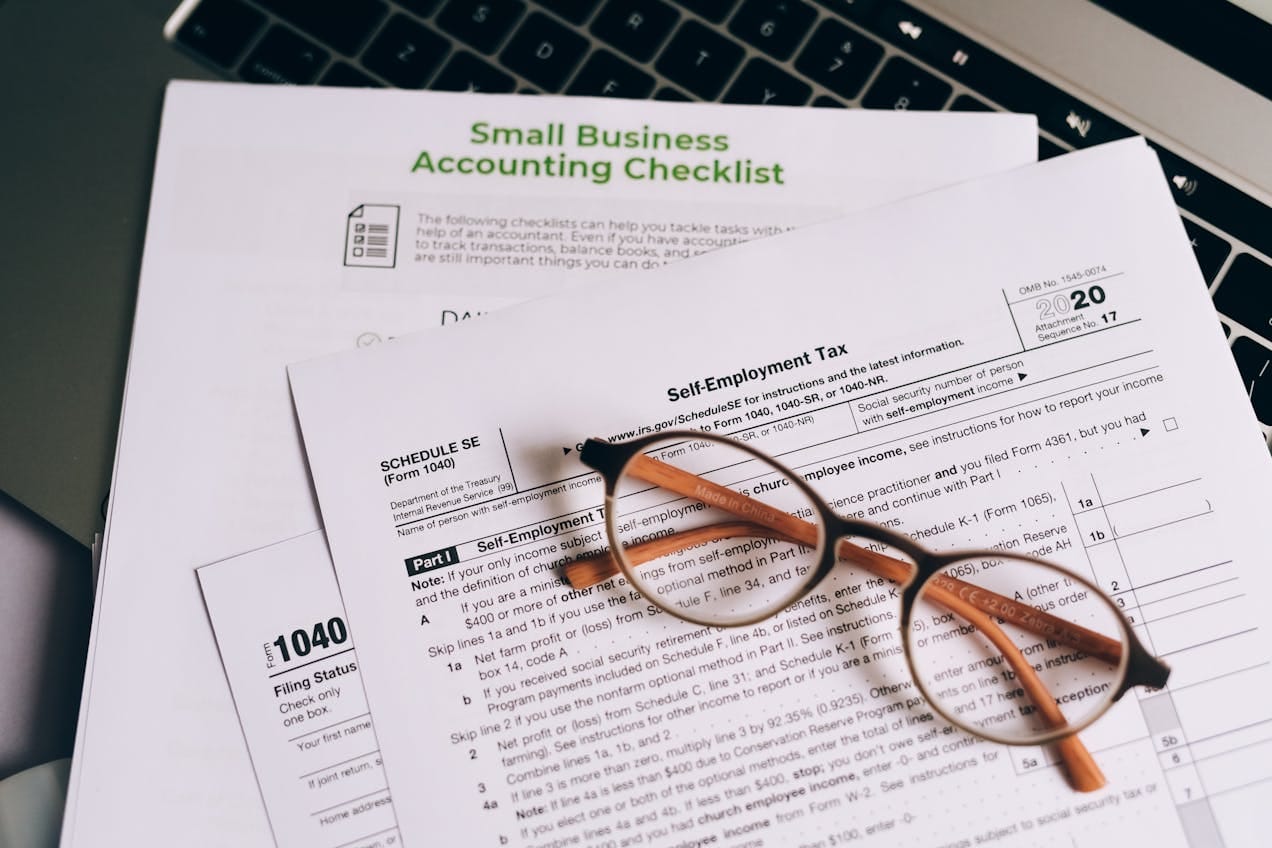

Tax Deductions for Small Businesses Small business owners often juggle multiple responsibilities, from managing clients to keeping cash flow steady. But one area that frequently gets ignored? Tax deductions....

With remote work becoming the new normal, many taxpayers are discovering that working from home introduces unique tax considerations. From home office deductions to multi-state taxation, it’s important to...

Introduction Restaurant owners face a relentless challenge: navigating complex tax codes while juggling slim margins and rising costs. Inexperienced CPAs often miss industry-specific deductions, leading to overpaid taxes and...

Introduction Truck drivers, whether owner-operators or independent contractors, face a tough reality: overpaying taxes due to missed deductions can erode hard-earned profits. Inexperienced CPAs often overlook industry-specific tax breaks,...

Introduction Builders and construction business owners face a harsh reality: overpaying taxes due to missed deductions can drain profits. Inexperienced CPAs often fail to identify critical tax breaks, leaving...

Introduction If you’re a handmade product seller on Shopify, your passion is creativity but what about the numbers behind the craft? Bookkeeping in 2025 is no longer optional. Whether...

Introduction Running a handmade product store on Shopify in 2025? You’re not just an artist you’re a business owner. That means tax deadlines, deduction rules, and compliance headaches. The...

Introduction Running a Print-on-Demand (POD) business through Amazon in 2025 sounds simple: upload a design, list it, and let Amazon handle the rest. But behind the scenes, sales tax...