Introduction The Inflation Reduction Act (IRA), signed into law in 2022, introduced significant tax provisions that impact individuals, businesses, and self-employed taxpayers. In 2025, several key provisions continue to...

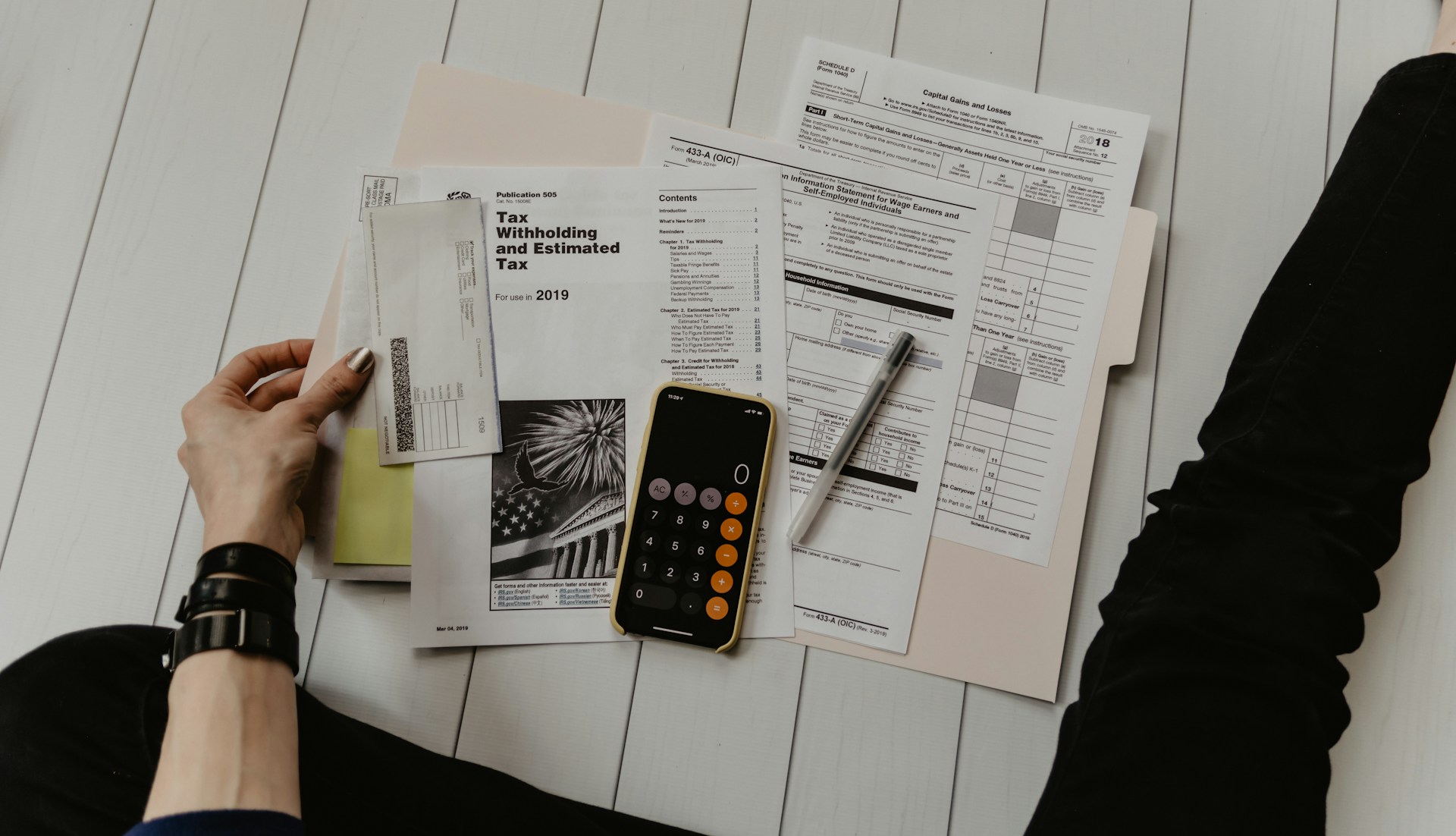

Introduction The IRS standard deduction is a key tax benefit that reduces taxable income, lowering the amount of taxes owed. Each year, the IRS adjusts the standard deduction to...

Introduction Each year, the IRS updates tax policies to reflect economic conditions, legislative changes, and enforcement priorities. The 2025 tax year brings several key updates that affect individuals, businesses,...

In the fast-paced realm of cryptocurrency, where fortunes can quickly shift hands, there’s one opponent that even the most adept traders may neglect: the tax collector. As digital currencies...

If you’re considering a crypto voyage, you’re in for a voyage filled with tax deductions and credits that could significantly lighten your fiscal burden. Cryptocurrency isn’t just revolutionizing money;...

The exciting world of cryptocurrency is a dynamic space where investment opportunities intersect with intricate tax rules. For many, this can be a daunting crossroads to navigate. The main...

In the digital age, where cryptocurrency has become a significant part of our financial landscape, understanding the complexities of crypto taxes has become more important than ever. With the...

Attention, business owners, CPAs, and attorneys in the USA! We’re about to drop some major knowledge that will make navigating the complex world of FINCEN and IRS compliance a...

Want a bigger tax refund in 2024? Discover the top IRS tax planning strategies that can maximize your refund and minimize your tax burden. Tax season can be a...

Are you ready to save thousands on your taxes this year? Discover the top IRS planning strategies for 2024 that will help you maximize your savings and minimize your...