Taxes for Your Side Hustle Earning extra income from a side hustle is exciting, but the IRS sees it as taxable income. Whether you’re freelancing, driving for Uber, selling...

Tax Deductions for Small Businesses Small business owners often juggle multiple responsibilities, from managing clients to keeping cash flow steady. But one area that frequently gets ignored? Tax deductions....

With remote work becoming the new normal, many taxpayers are discovering that working from home introduces unique tax considerations. From home office deductions to multi-state taxation, it’s important to...

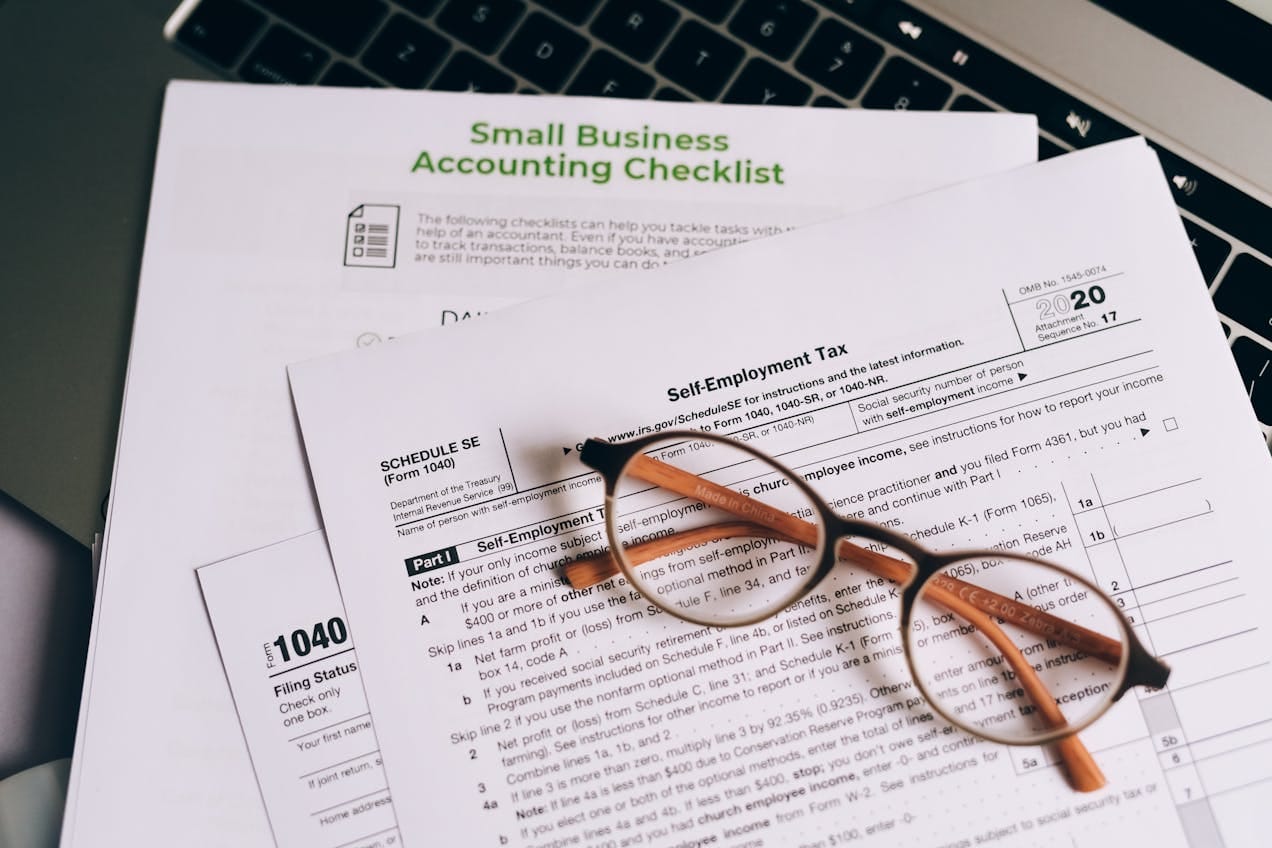

Introduction Unlike employees, independent contractors do not have taxes withheld from their payments. Instead, under IRC § 1402, they must pay self-employment tax and income tax directly to the...

Introduction Consultants and coaches—whether in business, fitness, life coaching, or professional development—often operate as self-employed professionals. This means they are responsible for self-employment taxes, business expenses, and estimated tax...

Introduction The home office deduction allows self-employed individuals to deduct a portion of their home expenses when they use a dedicated workspace for business. According to IRC § 280A,...

Introduction As a self-employed taxpayer, you are responsible for paying self-employment tax and reporting all business income. However, the IRS allows business deductions to help reduce Adjusted Gross Income...

Introduction Teachers often spend their own money on classroom supplies, professional development, and continuing education, yet many are unaware of the tax deductions and credits available to them. Whether...

Introduction Healthcare professionals, including doctors, nurses, dentists, therapists, and private practitioners, face unique tax challenges due to high income, self-employment taxes, and business expenses. Strategic tax planning can help...

Introduction Real estate agents operate as independent contractors or self-employed professionals, making tax planning crucial for maximizing deductions and reducing taxable income. Since agents often incur significant business expenses,...