The “183-Day” Escape Plan: Using Form 8840 and 8833 to Avoid US Residency One of the most stressful realizations for our international clients in 2025 was accidentally becoming a...

The Foreign-Owned US LLC: Why “Zero Income” Doesn’t Mean “Zero Filing” In 2025, a recurring issue for our international clients was the belief that a US LLC with no...

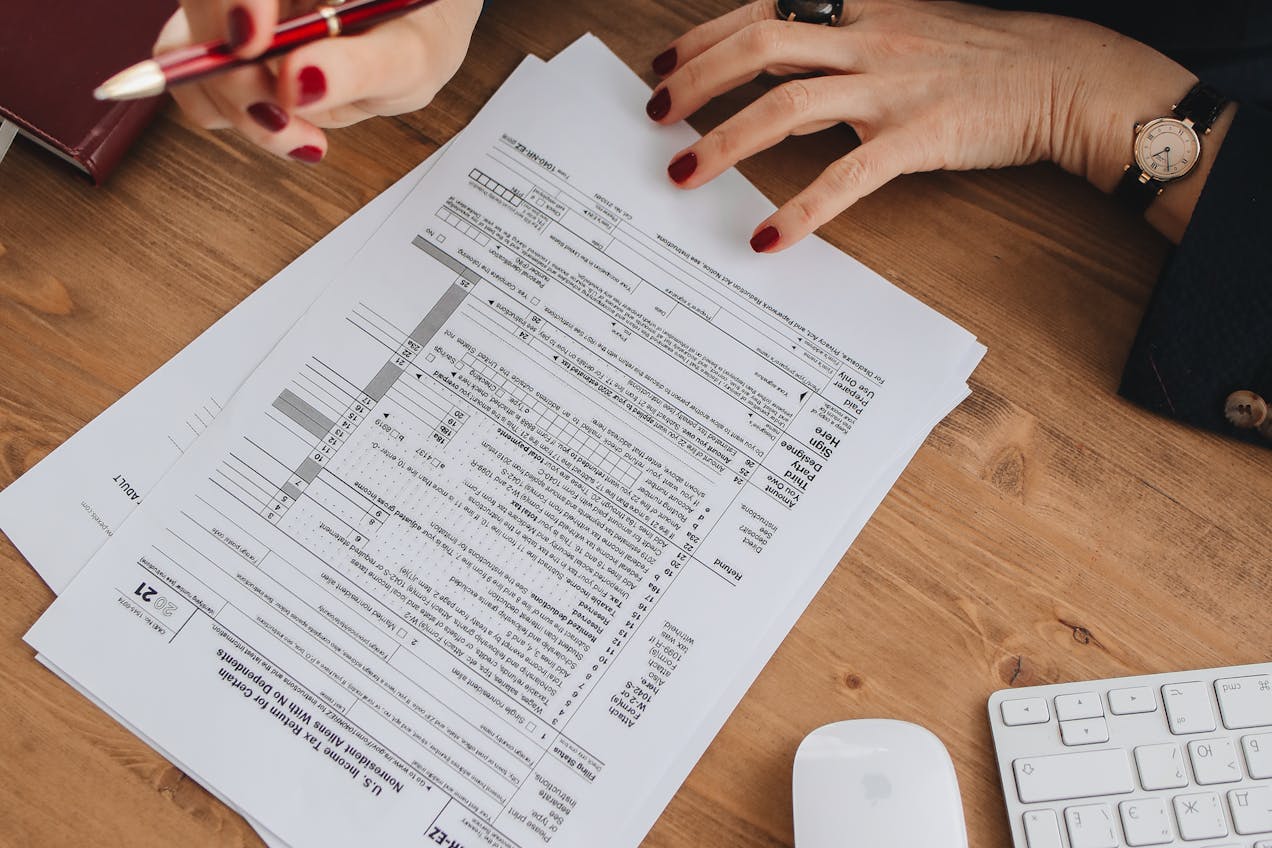

2025 Tax Deadlines for US Expats At KKCA, we understand that living abroad brings unique financial complexities. For US citizens and Green Card holders residing overseas, the tax calendar...

International Tax Toolkit Your essential guide to U.S.-India tax compliance under the OBBBA legislation. 1. Key Deadlines for 2026 Date Deadline Description Who It’s For Jan 15, 2026 Final...

2026 Tax Season is Here: The OBBBA Impact Report The 2026 filing season (covering your 2025 income) officially marks a new era in tax law. The One Big Beautiful...

The 2026 Compliance Revolution: New Forms and Stricter Oversight For business owners and expats, the 2026 filing season (reporting 2025 income) is not “business as usual.” The IRS has...

The Final Departure: Understanding the US Exit Tax and Form 8854 In 2025, we saw a surge in “Long-Term Residents” (Green Card holders for 8+ years) planning their permanent...

Digital Nomads & Crypto: Navigating the 2025 IRS “Crackdown” For many expats and digital nomads, cryptocurrency is more than an investment—it’s a tool for cross-border payments and financial freedom....

The Tax Treaty Shield: Protecting Your Foreign Pension from the IRS If you’ve spent your career in London, Toronto, or Mumbai before moving to the U.S., you likely have...

Indian EPF & PPF: The “Tax-Free” Growth Myth in the US The Public Provident Fund (PPF) and Employee Provident Fund (EPF) are the gold standards of retirement saving in...