In this era, where environmental sustainability is increasingly intertwined with fiscal strategies, the introduction of the new clean vehicle credit in the U.S. represents a transformative approach to encouraging...

Introduction Tax benefits play a vital role in supporting the financial stability of differently abled individuals in India. These provisions are designed to help mitigate the additional costs associated...

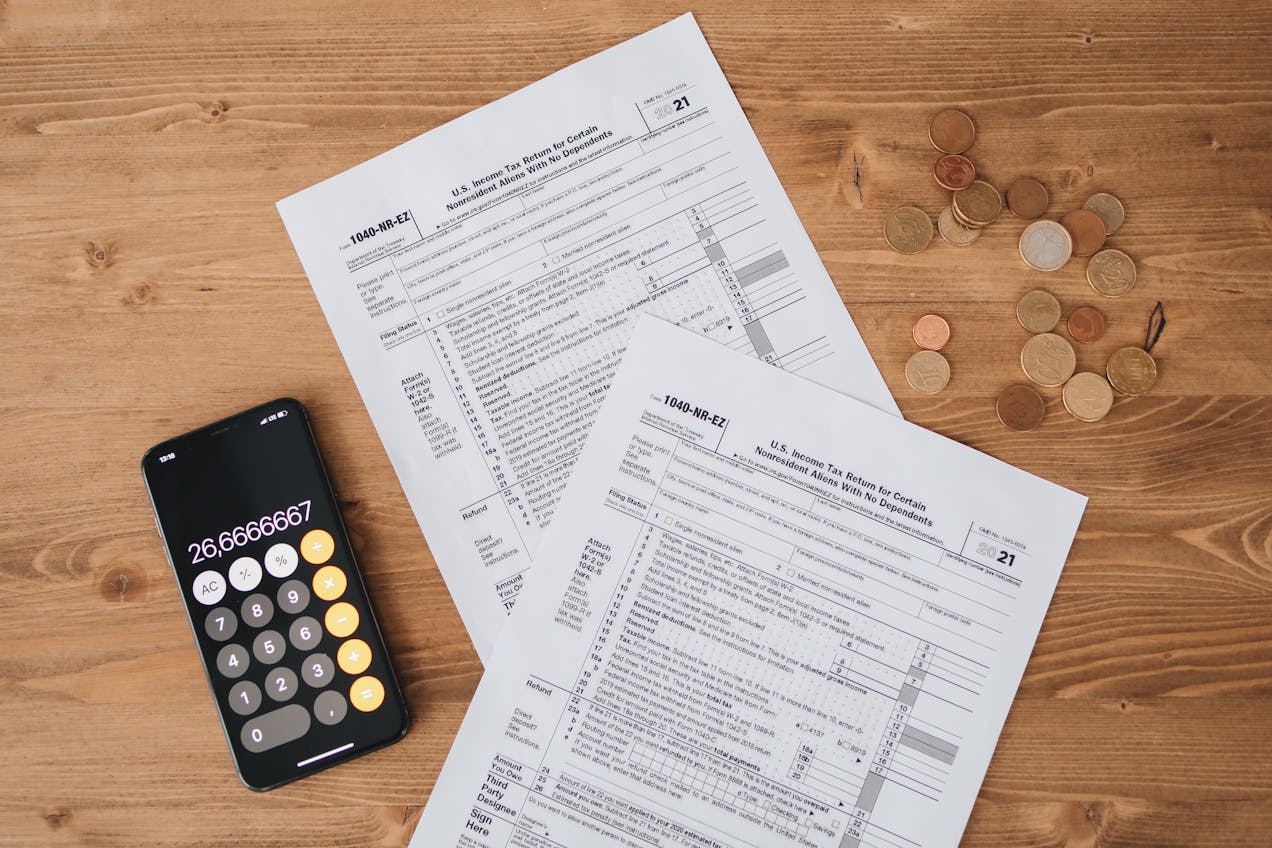

In the constantly shifting landscape of U.S. taxation, the standard deduction remains a fundamental feature for taxpayers who prefer simplicity and efficiency in managing their tax obligations. As we...

Introduction Tax Deducted at Source (TDS) is a proactive tax collecting mechanism used in India, where tax is automatically deducted from the income at the source. It helps in...

U.S. citizens worldwide are required to report their foreign financial assets under FATCA, which was enacted to combat tax evasion. It’s not just a legal requirement but a strategy...