Introduction Many taxpayers miss out on valuable deductions simply because they don’t know they exist. The IRS tax code allows for several deductions that can reduce taxable income, but...

Introduction Many taxpayers miss out on valuable deductions simply because they don’t know they exist. The IRS tax code allows for several deductions that can reduce taxable income, but...

Start with a compelling introduction that highlights the complexity and unique challenges US residents living abroad face regarding tax obligations. Mention the confusion around deductions and the importance of...

As tax season approaches, understanding the intricacies of State and Local Tax (SALT) deductions is crucial for California residents. The SALT deduction allows taxpayers to deduct certain taxes paid...

Mastering California Taxes for Non-Residents: Your 2023 Comprehensive Guide Confused by California’s tax rules for non-residents? You’re not alone! This definitive guide demystifies the 2023 tax obligations for US...

California’s tax system is designed to be progressive, meaning that the rate of taxation increases as taxable income increases. This approach aims to ensure a fairer distribution of the...

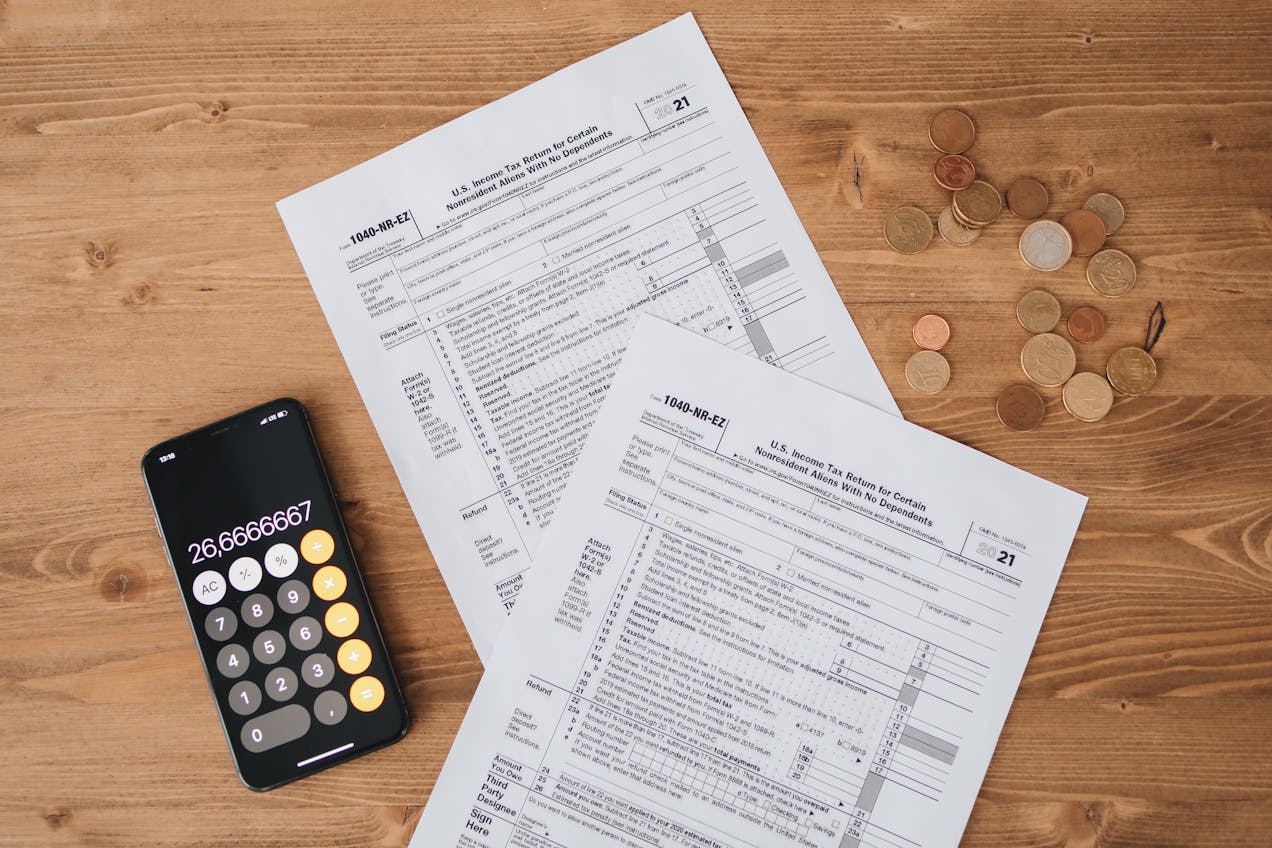

Filing Taxes Doesn’t Have to Be Overwhelming Tax season rolls around every year, yet somehow, it always manages to catch people off guard. Between gathering documents, figuring out deductions,...

Introduction Tax Deducted at Source (TDS) is a proactive tax collecting mechanism used in India, where tax is automatically deducted from the income at the source. It helps in...