Many Indian-American taxpayers are confused about how to handle money gifts from their parents in India. Is it taxable? Does it need to be reported? Will the IRS audit...

Problem: Why Most Indian-Americans Get This Wrong Indian mutual funds may seem like a smart investment. But for U.S. taxpayers especially Indian-Americans they come with a hidden trap: PFIC...

Many Indian-origin taxpayers living in the U.S. invest in Indian mutual funds like HDFC, ICICI, or SBI schemes without realizing these may be classified as Passive Foreign Investment Companies...

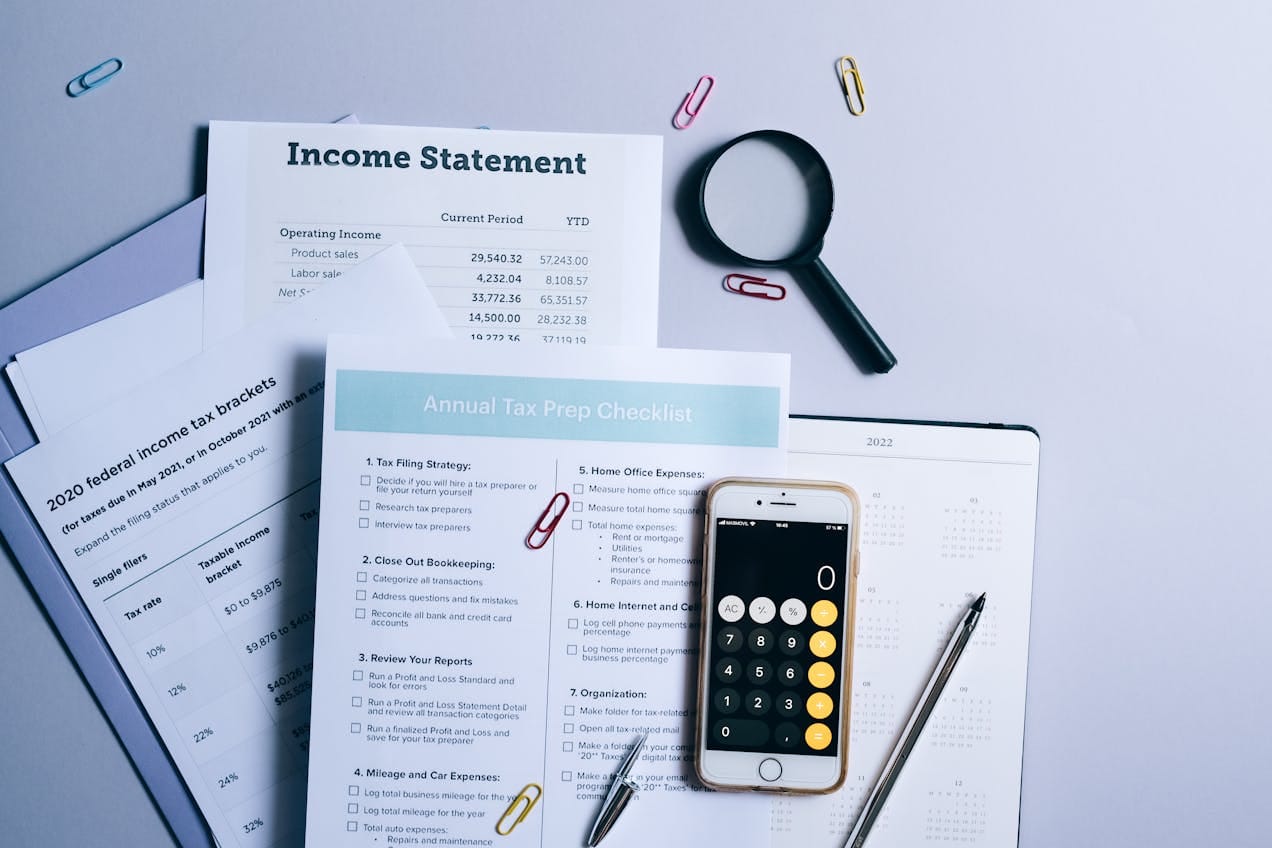

Need a Financial Plan A great business idea can get you started, but a solid financial plan keeps you going. As an entrepreneur, your success doesn’t just hinge on...

Sustainable businesses are at the forefront of innovation and growth—and the U.S. tax code now strongly rewards eco-conscious decisions. From solar panels to energy-efficient buildings, there are multiple tax...

As 2025 unfolds, new tax laws and phase-outs are reshaping the landscape for individuals, entrepreneurs, and small businesses alike. Understanding these changes can help you reduce liability, avoid penalties,...

Introduction Investors and business owners frequently face the sting of capital gains taxes, which can erode portfolio returns and diminish wealth-building efforts, especially in a dynamic market. Inexperienced tax...

Business Taxes Before Year-End Business owners often find themselves racing against the clock at year-end, grappling with mounting tax liabilities that erode profits and constrain growth. Inexperienced tax preparers...

Introduction Business owners and self-employed professionals often grapple with high tax burdens, missing out on significant deductions due to complex tax codes and inexperienced advisors. The Qualified Business Income...

Introduction Small business owners face a critical decision when choosing an entity structure, as the wrong choice can lead to excessive taxes, compliance burdens, or missed deductions, stifling growth...