Introduction Technology is transforming auditing processes, fraud detection, and financial compliance. Businesses now rely on AI, blockchain, automation, and data analytics to improve audit accuracy, reduce errors, and detect...

Introduction Accounting fraud occurs when financial records are manipulated to deceive stakeholders, evade taxes, or hide losses. Fraud can result in legal penalties, financial losses, and reputational damage. This...

Introduction Internal controls are financial and operational safeguards that businesses use to prevent fraud, reduce errors, and ensure compliance with tax and regulatory requirements. Strong internal controls help companies...

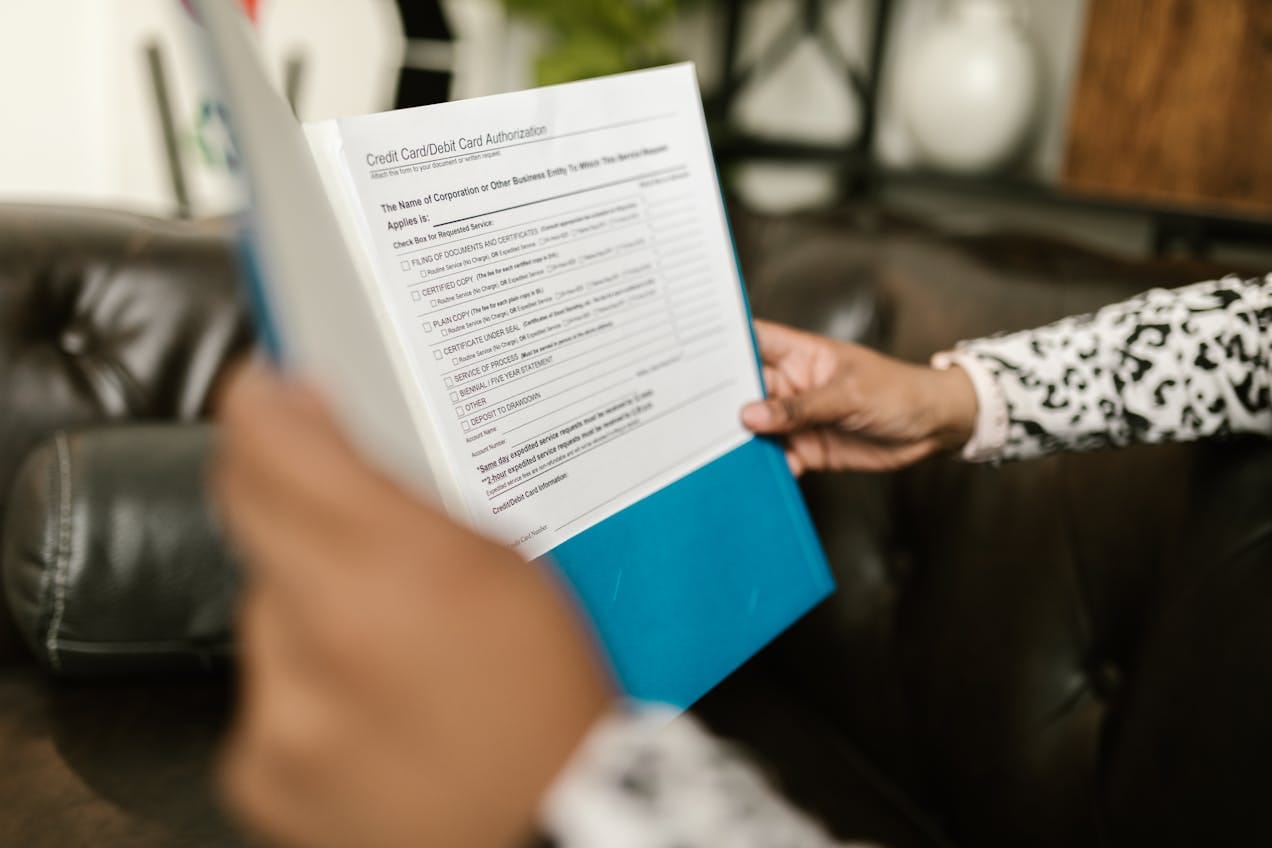

Introduction Under the Corporate Transparency Act (CTA), precise compliance with beneficial ownership reporting requirements is essential. While most discussions focus on who qualifies as a beneficial owner, it is...

Introduction As regulatory frameworks become more stringent in the United States, particularly with the implementation of the Corporate Transparency Act (CTA), it is crucial to grasp the detailed reporting...

Introduction In the ever-changing landscape of U.S. financial regulations, the importance of understanding and leveraging safe harbor provisions cannot be overstated. These provisions are crucial for entities required to...