Need a Financial Plan A great business idea can get you started, but a solid financial plan keeps you going. As an entrepreneur, your success doesn’t just hinge on...

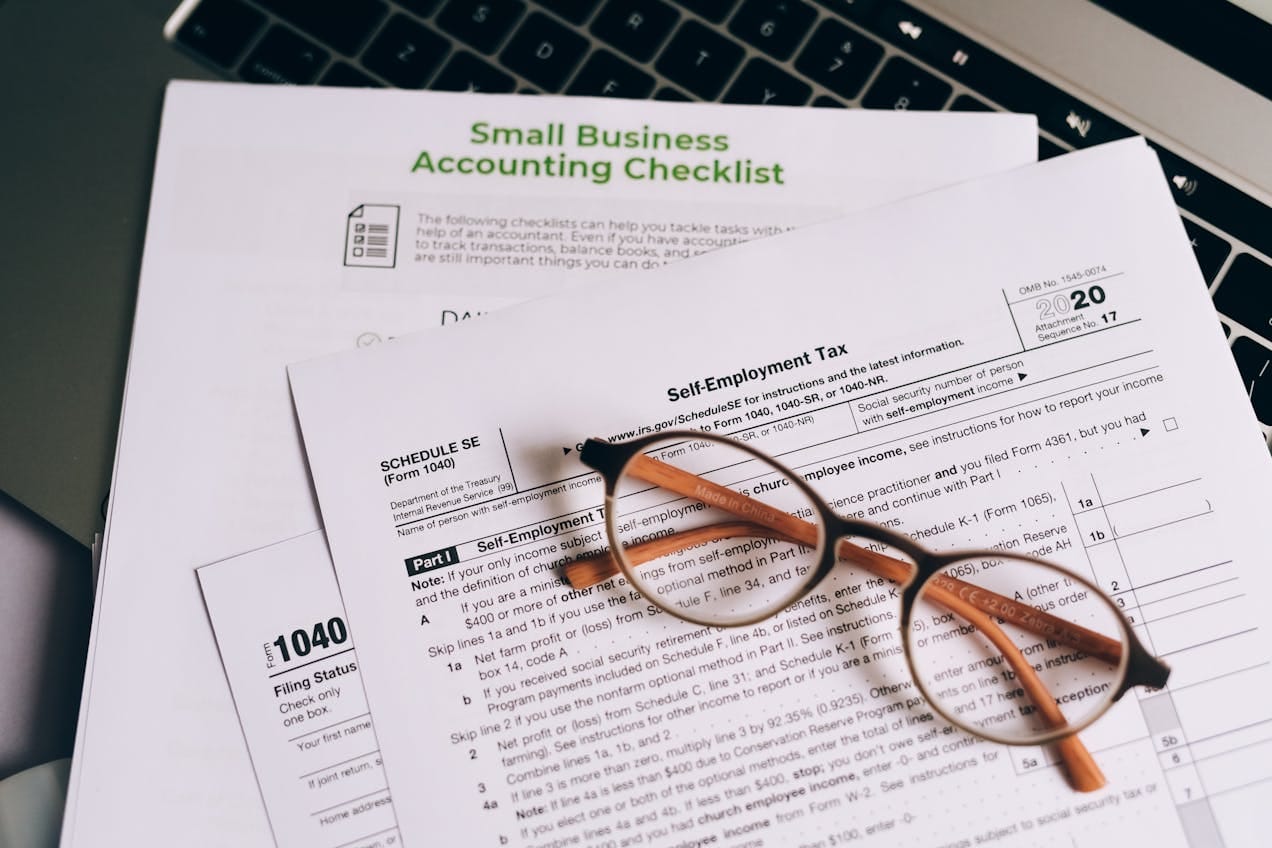

Tax Deductions for Small Businesses Small business owners often juggle multiple responsibilities, from managing clients to keeping cash flow steady. But one area that frequently gets ignored? Tax deductions....

Business Taxes Before Year-End Business owners often find themselves racing against the clock at year-end, grappling with mounting tax liabilities that erode profits and constrain growth. Inexperienced tax preparers...

Introduction Small business owners frequently encounter the burden of substantial upfront costs for essential equipment, compounded by tax implications that can diminish profitability if not managed effectively. Inexperienced tax...

Introduction Restaurant owners face a relentless challenge: navigating complex tax codes while juggling slim margins and rising costs. Inexperienced CPAs often miss industry-specific deductions, leading to overpaid taxes and...

Introduction Builders and construction business owners face a harsh reality: overpaying taxes due to missed deductions can drain profits. Inexperienced CPAs often fail to identify critical tax breaks, leaving...

Introduction If you’re a handmade product seller on Shopify, your passion is creativity but what about the numbers behind the craft? Bookkeeping in 2025 is no longer optional. Whether...

Introduction Are you using Shopify POS to manage in-store sales and selling products simultaneously on Amazon? Congrats you’re operating a hybrid retail model that maximizes reach. But in 2025,...

Introduction If you use Fulfillment by Amazon (FBA), you already know the power of Amazon’s logistics network. But are you leaving money on the table when it comes to...

Wholesale Sellers on Shopify Managing inventory for wholesale clients on Shopify involves more than tracking large order volumes – it requires precise costing, compliance with IRS capitalization rules, and...