In the vast and intricate realm of corporate finance, understanding and managing cash flow is crucial—it’s virtually the lifeblood of any business. As a Certified Public Accountant with a...

In the complex landscape of corporate finance, a deep understanding of capital structure and effective funding strategies is crucial for any business seeking to optimize financial performance and fuel...

In the multifaceted realm of business finance, strategic cost management and profitability analysis serve as critical drivers of a company’s journey toward sustained growth and operational efficiency. As a...

Introduction Tax Deducted at Source (TDS) is a proactive tax collecting mechanism used in India, where tax is automatically deducted from the income at the source. It helps in...

Tired of the Long, Drawn-Out Tax Dispute Process? Relief is Here! Are you one of the many US residents living overseas dealing with IRS compliances and tax disputes? There’s...

Proactive Tax Planning: Why Start Early? As the new financial year begins, the benefits of initiating tax strategies early are clear. This approach provides enough time to align your...

Introduction As part of its commitment to encourage financial independence and empower women, the Indian government provides several tailored tax benefits. These benefits not only aim to boost savings...

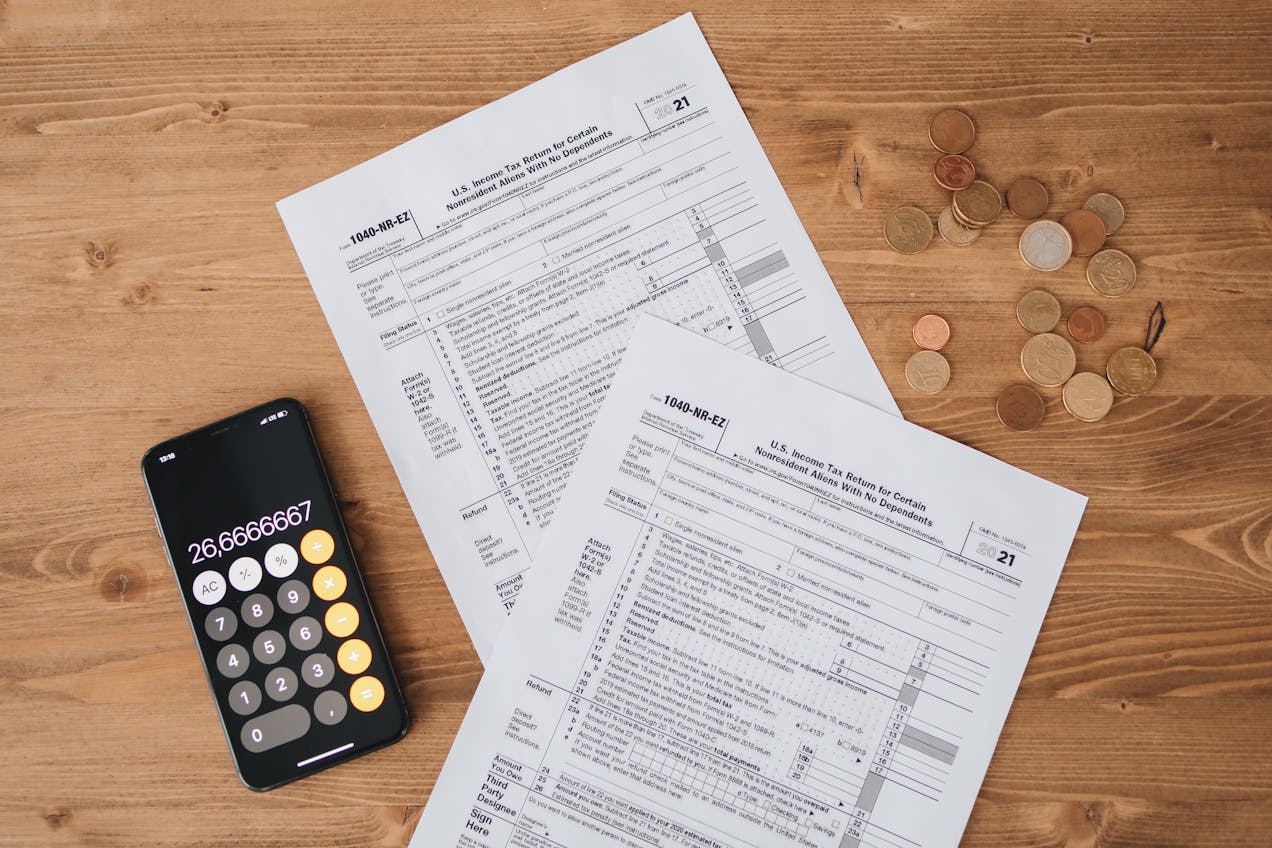

Getting married to a nonresident has significant implications for your U.S. tax obligations. Knowing these implications is crucial to effective financial planning and compliance. Considerations for filing status If...

Find out how you can brighten your financial future by avoiding double taxes! A U.S. expatriate’s tax obligations can seem daunting. In the event that your hard-earned money is...

U.S. citizens worldwide are required to report their foreign financial assets under FATCA, which was enacted to combat tax evasion. It’s not just a legal requirement but a strategy...