Introduction Reduce Business Costs Reducing business costs is essential for improving profit margins and financial stability, but cutting expenses should not compromise quality. Smart cost-cutting strategies help businesses stay...

Introduction The IRS audits less than 1% of tax returns, but certain red flags increase the risk of an audit. Whether you are an individual taxpayer, freelancer, or business...

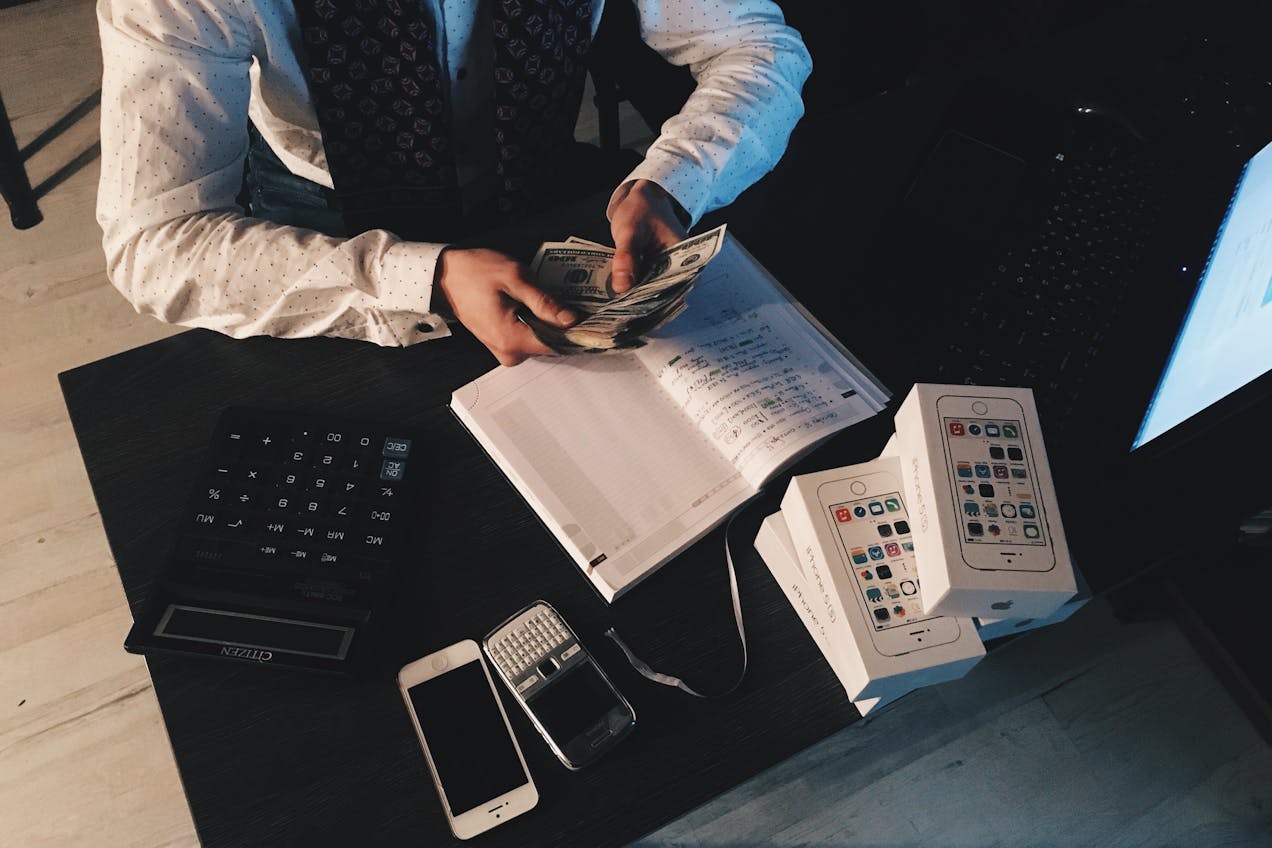

Introduction Freelancers and self-employed individuals often miss valuable tax deductions that could significantly reduce their taxable income. Unlike W-2 employees, freelancers must pay self-employment taxes and cover their own...

Introduction IRS audits can be stressful, but understanding common audit red flags can help businesses and individuals avoid unnecessary scrutiny. The IRS uses automated systems and manual reviews to...

Introduction Understanding the difference between fixed and variable costs is essential for budgeting, pricing strategies, and profit optimization. Fixed costs remain constant regardless of sales volume, while variable costs...

Introduction A business budget is a financial roadmap that helps manage expenses, forecast revenue, and ensure profitability. Proper budgeting allows businesses to control costs, allocate resources effectively, and plan...

Introduction Cost accounting is a financial management tool that helps businesses track, analyze, and control costs. It provides insights into production costs, profitability, and pricing strategies, enabling businesses to...

Introduction Small businesses must follow IRS tax regulations to avoid costly mistakes that can lead to penalties, audits, and overpaying taxes. Common tax errors include misreporting income, missing deductions,...

Introduction A tax audit is an IRS review of a taxpayer’s financial records and tax return to verify accuracy and compliance with tax laws. While most businesses and individuals...

Introduction Tax accounting focuses on preparing, managing, and filing taxes in compliance with IRS regulations. Unlike financial accounting, which tracks overall business performance, tax accounting ensures businesses and individuals...