Introduction Teachers and educators often spend their own money on classroom supplies, but the IRS provides some tax relief through the Educator Expense Deduction. Under IRC § 62(a)(2)(D), eligible...

Introduction Donating to charity not only supports important causes but may also provide tax savings. Under IRC § 170, taxpayers who itemize deductions can deduct qualified charitable contributions to...

Introduction If you had high medical expenses in 2025, you might be able to deduct them on your tax return and reduce your taxable income. The IRS allows you...

Introduction If you’re making student loan payments, you may be eligible for a tax deduction that reduces your taxable income. The student loan interest deduction, outlined in IRC §...

Introduction The home office deduction allows self-employed individuals to deduct a portion of their home expenses when they use a dedicated workspace for business. According to IRC § 280A,...

Introduction If you use your vehicle or travel for business purposes, the IRS allows you to deduct business mileage and travel expenses to lower your taxable income. According to...

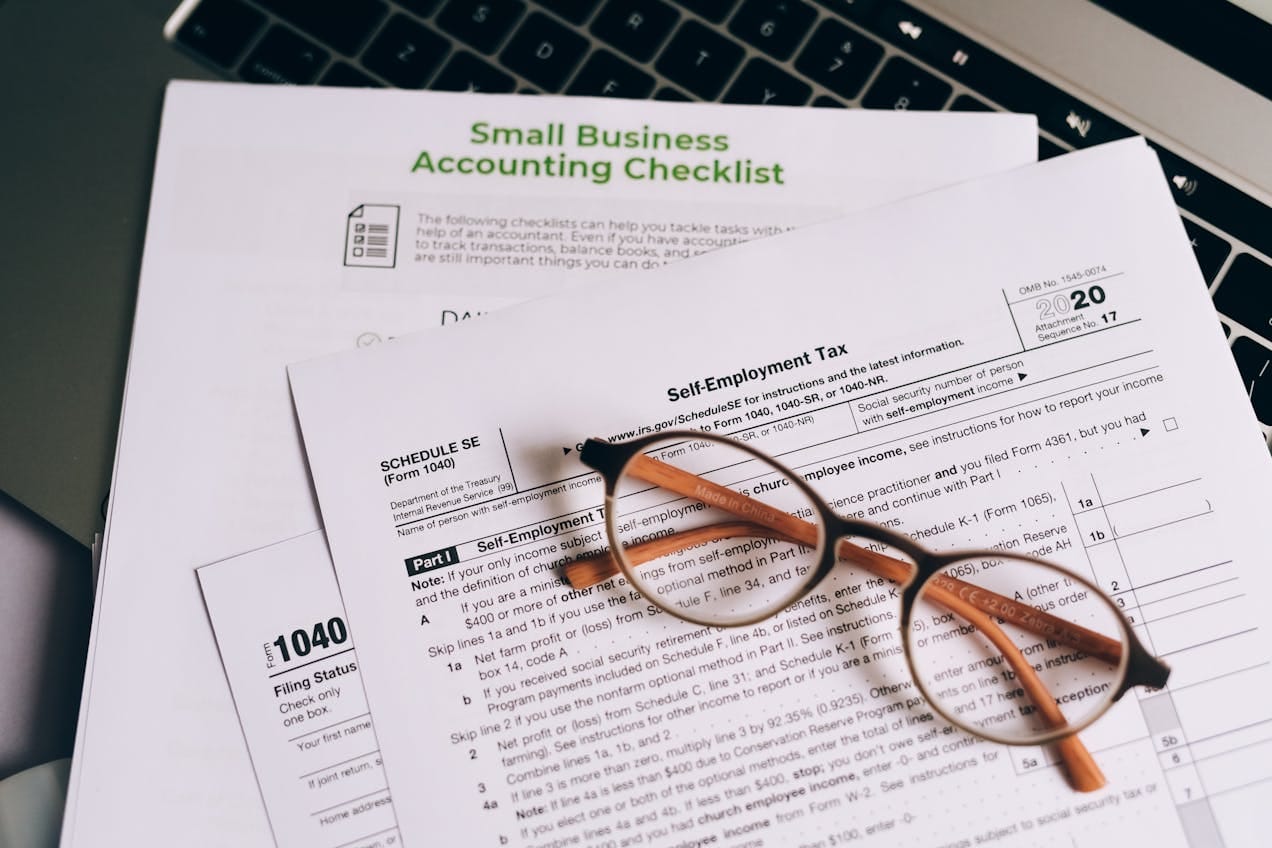

Introduction As a self-employed taxpayer, you are responsible for paying self-employment tax and reporting all business income. However, the IRS allows business deductions to help reduce Adjusted Gross Income...

Introduction Lowering your Adjusted Gross Income (AGI) is a smart tax strategy that can help you qualify for deductions, credits, and lower tax brackets. IRC § 62 defines AGI...

Introduction Teachers often spend their own money on classroom supplies, professional development, and continuing education, yet many are unaware of the tax deductions and credits available to them. Whether...

Introduction Healthcare professionals, including doctors, nurses, dentists, therapists, and private practitioners, face unique tax challenges due to high income, self-employment taxes, and business expenses. Strategic tax planning can help...