Annualize Gross Receipts Businesses that operate for less than 12 months in a tax year — due to incorporation, merger, dissolution, or change in accounting period — must annualize...

Introduction Small business owners face a critical decision when choosing an entity structure, as the wrong choice can lead to excessive taxes, compliance burdens, or missed deductions, stifling growth...

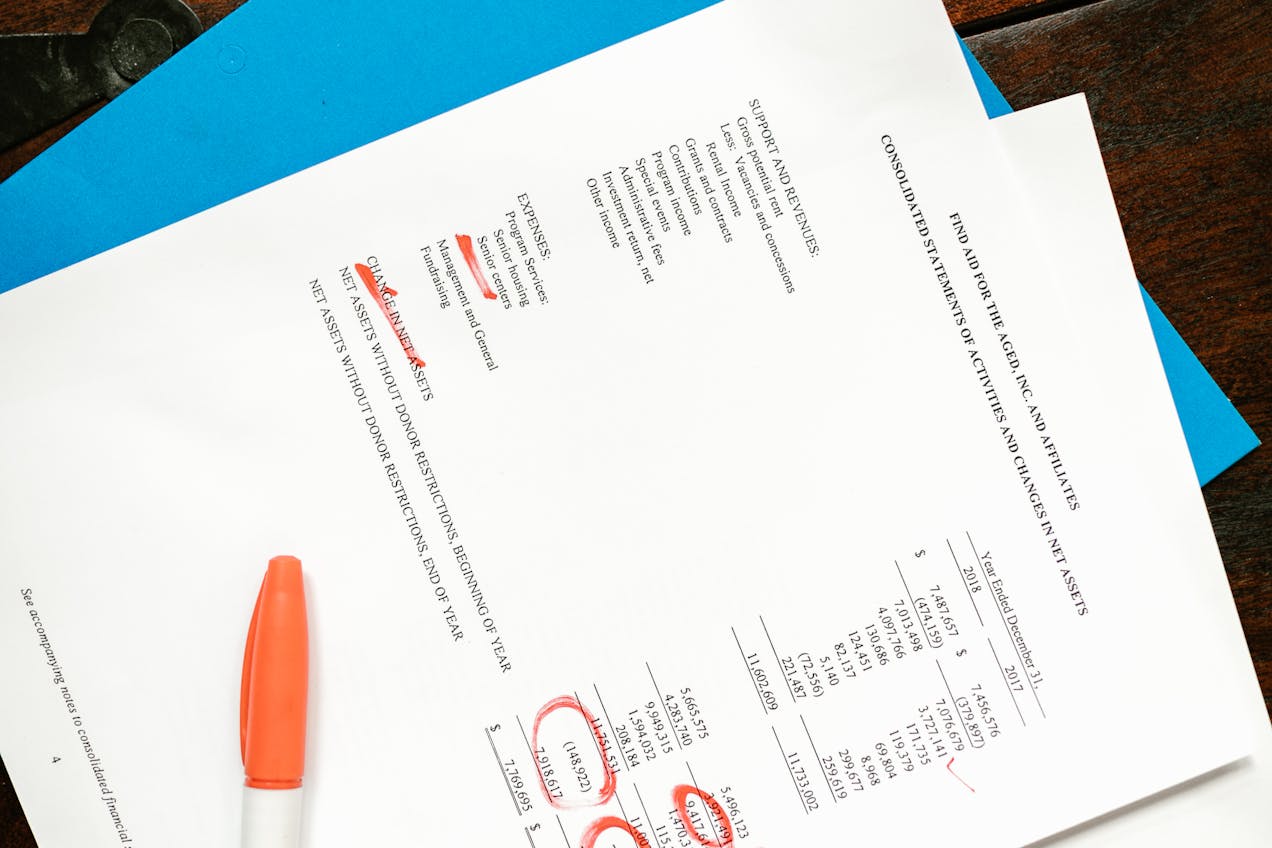

Introduction Tax-exempt organizations, including nonprofits and charities, frequently navigate the complexities of unrelated business income tax (UBIT), where income from activities unrelated to their exempt purpose can trigger unexpected...

Introduction Small business owners in high-tax states like California and New York often grapple with the federal limitation on state and local tax (SALT) deductions, which can inflate their...

Introduction Truck drivers, whether owner-operators or independent contractors, face a tough reality: overpaying taxes due to missed deductions can erode hard-earned profits. Inexperienced CPAs often overlook industry-specific tax breaks,...

Unlock Massive Tax Savings for Your Tech Startup! Are you a tech entrepreneur in California struggling with initial losses? Don’t let those losses go to waste. California’s Net Operating...

Introduction To enhance financial transparency and combat illicit activities, the United States has enforced strict reporting requirements under the Corporate Transparency Act (CTA). This act mandates that certain entities...

As regulatory scrutiny intensifies in the United States, particularly with the enforcement of the Corporate Transparency Act (CTA), it has become crucial for companies to accurately identify their beneficial...