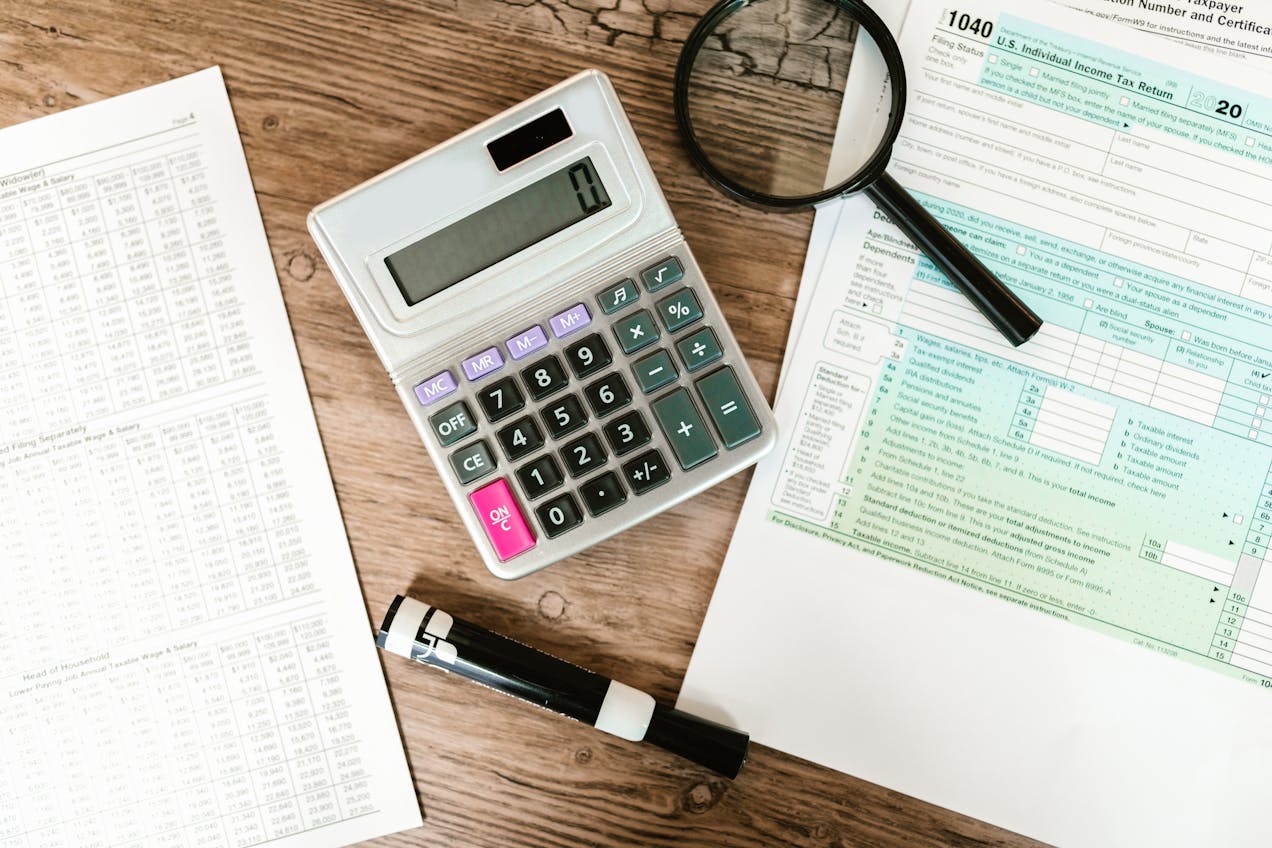

Introduction Each year, the IRS updates tax policies to reflect economic conditions, legislative changes, and enforcement priorities. The 2025 tax year brings several key updates that affect individuals, businesses,...

Introduction Many taxpayers miss out on valuable deductions simply because they don’t know they exist. The IRS tax code allows for several deductions that can reduce taxable income, but...

Introduction Legal fees can be expensive, but some may be tax-deductible if they meet IRS guidelines. The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated most personal legal...

Introduction The Child Tax Credit (CTC) is a valuable tax benefit for families with dependent children, helping to reduce tax liability and, in some cases, provide a refund. The...

Introduction Small business owners and self-employed individuals often use their vehicles for work-related purposes. The IRS allows deductions for business-related car expenses, but specific rules apply. You can choose...

Introduction Business travel can be a significant expense, but the IRS allows deductions for ordinary and necessary travel costs related to your work. Whether you’re a self-employed professional, freelancer,...

Introduction Medical expenses can be a significant financial burden, but the IRS allows taxpayers to deduct qualified medical costs that exceed a certain percentage of their adjusted gross income...

Introduction Many taxpayers miss out on valuable deductions simply because they don’t know they exist. The IRS tax code allows for several deductions that can reduce taxable income, but...

Introduction Being self-employed offers flexibility and financial independence, but it also comes with tax responsibilities that differ from traditional employees. Unlike W-2 workers, self-employed individuals must report income, track...

Introduction Claiming a dependent on your tax return can provide significant tax savings, including tax credits and deductions. However, the IRS has specific rules and qualifications that determine who...