Introduction A compliance audit ensures that a business follows legal, financial, and industry regulations. It verifies whether a company meets IRS tax laws, employment rules, financial reporting standards, and...

Introduction Technology is transforming auditing processes, fraud detection, and financial compliance. Businesses now rely on AI, blockchain, automation, and data analytics to improve audit accuracy, reduce errors, and detect...

Introduction An internal audit helps small businesses assess financial accuracy, risk management, and compliance with tax and regulatory requirements. Regular audits help detect errors, fraud, and inefficiencies, ensuring smoother...

Introduction Auditors play a crucial role in ensuring financial accuracy, detecting fraud, and verifying tax compliance. Whether conducting internal, external, or forensic audits, auditors help businesses maintain financial integrity...

Introduction Internal controls are financial and operational safeguards that businesses use to prevent fraud, reduce errors, and ensure compliance with tax and regulatory requirements. Strong internal controls help companies...

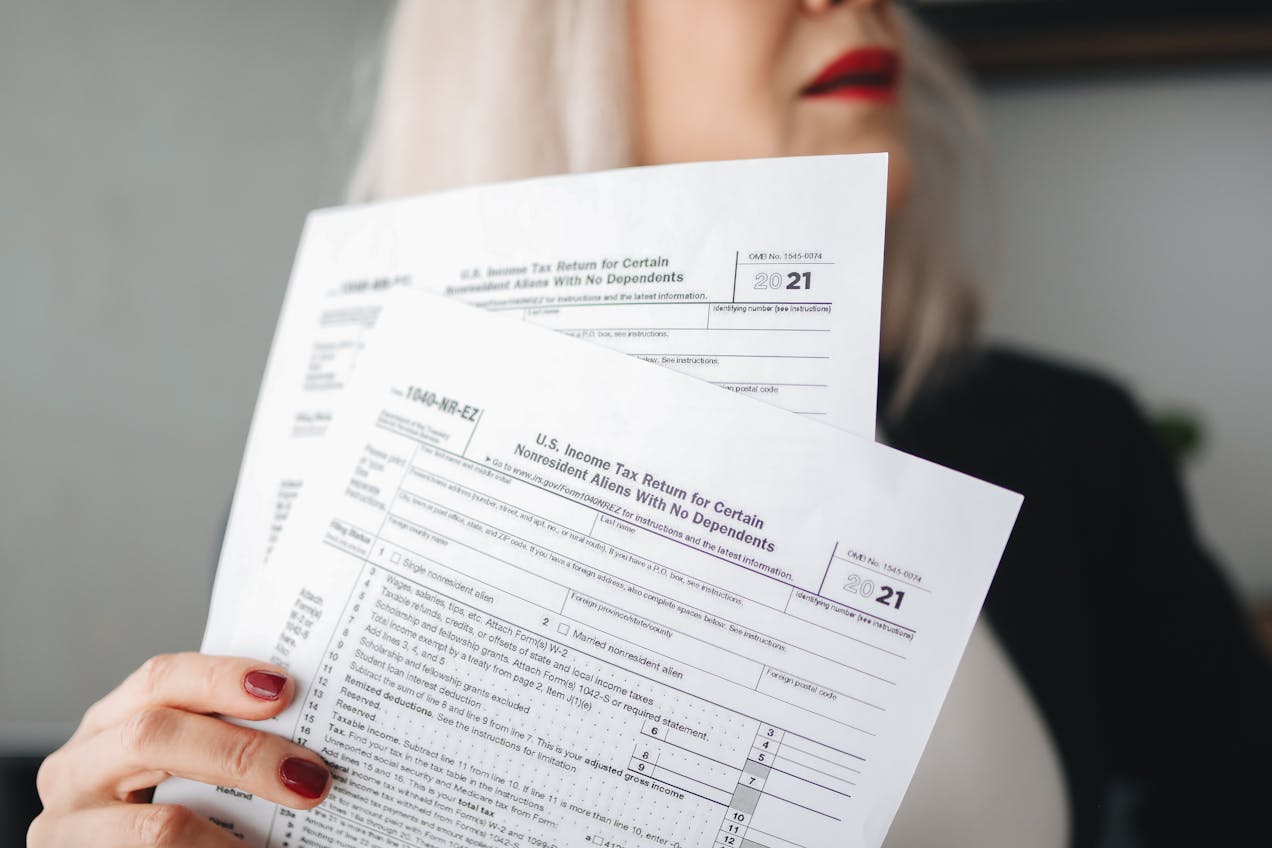

Owning a Delaware LLC as a U.S. expat involves unique complexities, especially when it comes to legal and regulatory compliance. One essential requirement is the appointment of a registered...