In the complex realm of U.S. taxation, the Child Tax Credit (CTC) serves as a critical financial relief mechanism for families, offering substantial benefits that can significantly reduce the...

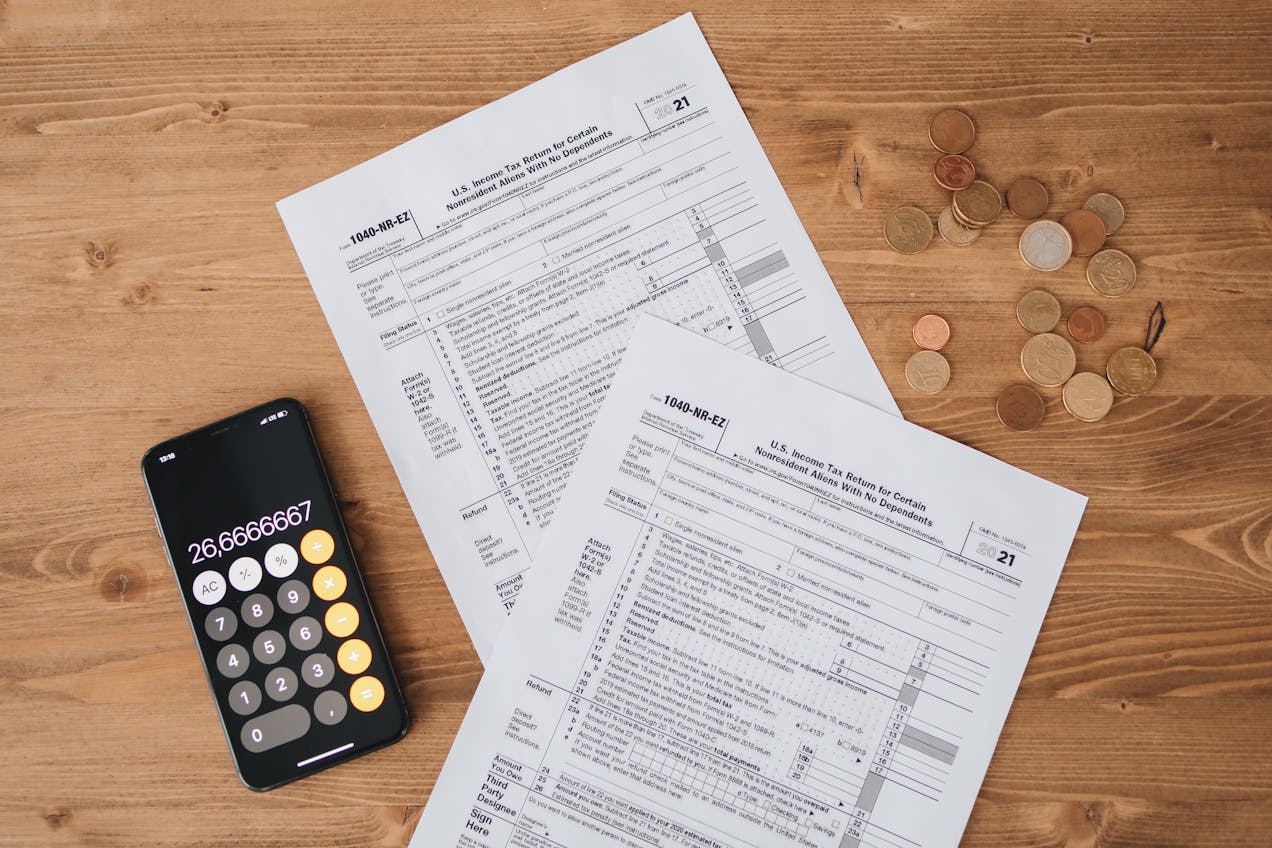

Introduction Tax Deducted at Source (TDS) is a proactive tax collecting mechanism used in India, where tax is automatically deducted from the income at the source. It helps in...

The Indian Premier League (IPL) transcends the boundaries of a conventional cricket tournament, establishing itself as a global sports spectacle. Its inception in 2008 marked the beginning of a...