BusinessQuality Assurance System

Ensuring Excellence in Financial Services

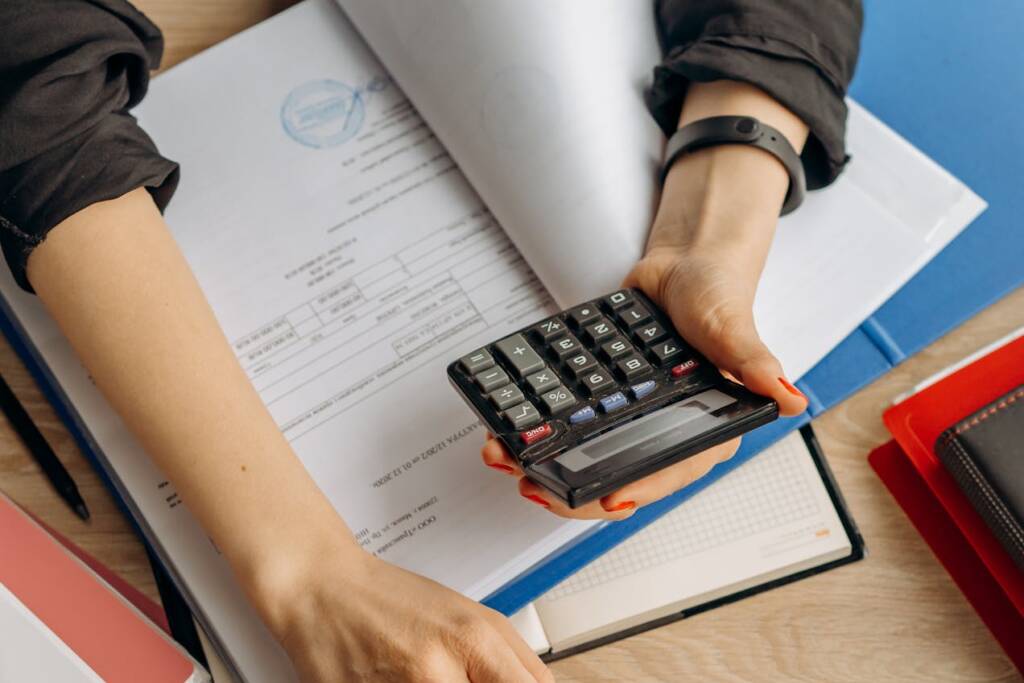

At Kewal Krishan & Co, we understand the critical role of quality control in delivering precise and reliable financial reporting. Our focus is on maintaining supreme accuracy and consistency through stringent quality control measures. Our team, comprising skilled and seasoned accountants, receives ongoing training to stay abreast of the latest in accounting standards and practices. Regular assessments and updates of our processes and software tools are conducted to ensure adherence to the highest quality standards.

Defining Quality Benchmarks

As a premier provider of outsourced accounting and tax services, we cater to the diverse financial needs of small to medium-sized enterprises. Our team, comprising experts including enrolled agents, certified public accountants and chartered accountants, is dedicated to elevating your financial management.

Structured Procedures

Our procedures, meticulously documented, include comprehensive guides and templates to ensure consistent execution of accounting tasks.

Continuous Improvement

We routinely evaluate and refine our quality control processes, implementing necessary adjustments to uphold high levels of accuracy and consistency.

Our Quality Standards

Standard Operating Procedures (SOPs) and a Quality Control Plan are essential in delivering precise and reliable outsourced accounting services. SOPs provide detailed, step-by-step guidelines for various accounting tasks, ensuring consistency from basic data entry to complex financial statement preparation. The Quality Control Plan sets forth our commitment to excellence, defining standards for accuracy, promptness, completeness, and regulatory compliance. This plan encompasses regular quality assessments, feedback mechanisms, and corrective actions, along with comprehensive training and performance evaluations. Continually revised to stay current with evolving accounting practices, these procedures enable us to consistently meet client needs with high-quality accounting services.

Standard Operating Procedures (SOPs)

SOPs are in place for every accounting task, ensuring a systematic approach from data entry to financial statement preparation.

Quality Control Plan

This plan details our quality standards and includes regular quality assessments, feedback mechanisms, and corrective actions.

Role Clarity and Task Management

Clear definitions of roles and responsibilities, coupled with precise task assignments and proper training, fortify our quality control.

Training and Orientation

Comprehensive training programs ensure that all team members are aligned with our quality standards and procedures.

Consistent Quality Checks

Both team self-checks and Quality Control Team reviews are integral to maintaining our high-quality standards.

Feedback and Corrective Actions

We actively incorporate feedback and make procedural adjustments to continuously enhance our service quality.

Our Profile

We Provide Services in Following Countries

Latest blog posts

- 06 Nov 2024

Essential Deadlines for California C Corp Taxes in 2024

Operating a California C Corporation comes with a set of important responsibilities, especially when it...

- 30 Oct 2024

Smart Tax Strategies for Better Savings in 2024

Tired of seeing a big part of your earnings disappear into taxes? What if there...

- 25 Oct 2024

Unlocking the Secrets of Business Income: How Every Dollar You Earn Can Work for You

Ever wondered why some businesses thrive while others struggle just to break even? The secret...

- 10 Aug 2024

Common Mistakes to Avoid When Applying for an IRS Tax ID from Abroad

Are you a U.S. resident living abroad and finding it difficult to obtain your IRS...

- 09 Aug 2024

Consequences of Missing UK Corporate Tax and Annual Report Deadlines

Did you know that missing UK corporate tax and annual report deadlines can result in...

- 09 Aug 2024

Taxation of US LLC in Delaware Owned by Indian Citizens: A Comprehensive Guide

Introduction As an Indian citizen, forming a US Limited Liability Company (LLC) in Delaware can...

Firm Brochure

Know more about our firm executives, international tax practice and core services aligning our selves with the ever dynamic out paced competitive world.