Trusted by the Indian Community &

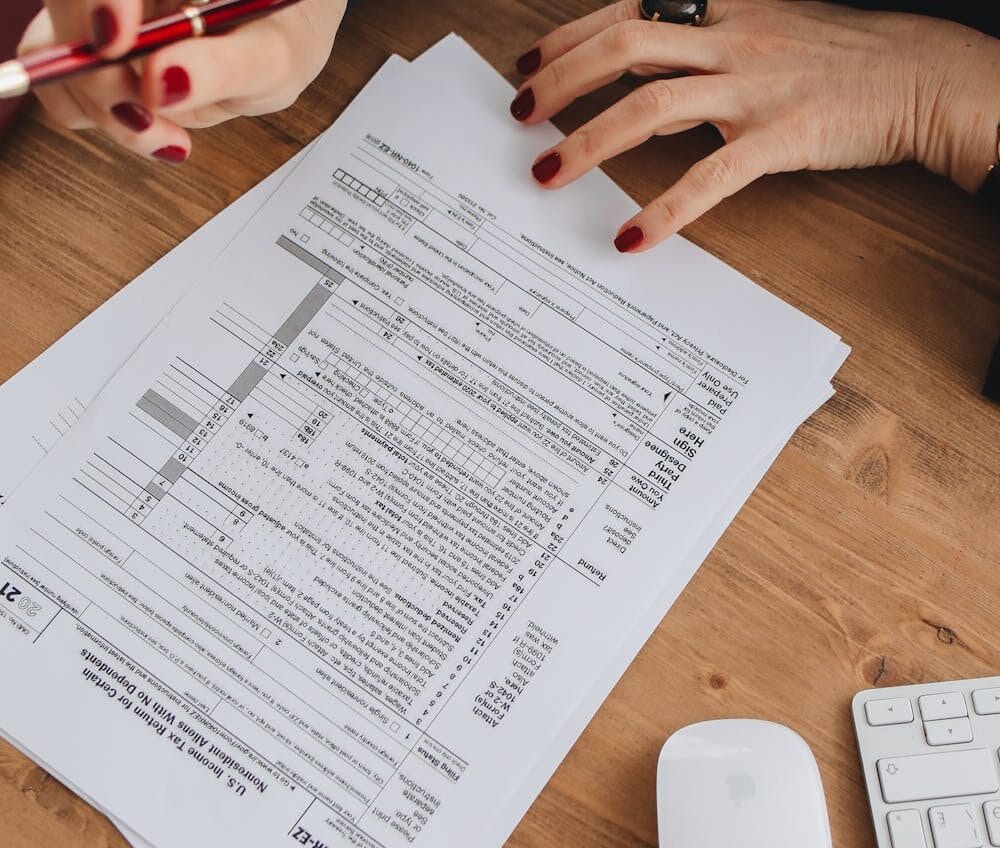

American Taxpayers Nationwide

Trusted by clients worldwide with top ratings for expert IRS tax services and unmatched client support.

We use cutting-edge tax software and a secure portal for seamless document sharing and hassle-free services.

From tax planning to IRS filings, audits, and compliance, we handle everything so you don’t have to go anywhere else.

We help individuals, businesses, expats, and foreign founders navigate complex U.S. tax laws with ease.

Your Trusted Tax Pro for IRS & Foreign In Reporting

At Kewal Krishan & Co, we offer proactive tax solutions tailored for individuals, expats, and business owners dealing with international tax complexities. From reporting foreign income and claiming tax treaty benefits to helping foreign founders with U.S. tax compliance, we ensure that no tax-saving opportunity is overlooked while keeping you 100% IRS compliant.

Smart Solutions Designed for your business

Start your business with ease! We assist with LLC, S-Corp, and C-Corp formation, EIN registration, operating agreements, and compliance filings to help you establish your business correctly.

Comprehensive federal tax compliance services including individual and business tax returns, tax resolution, IRS audit representation, and penalty abatements.

Keep your finances in order with our monthly bookkeeping, financial reporting, reconciliations, and expense tracking to ensure accurate records and tax-ready financials.

Expert tax filing services for California businesses and individuals, covering Franchise Tax Board (FTB) compliance, LLC & corporate tax filings, CDTFA sales tax, and payroll tax.

Our Work Process

Initial call to understand your business needs, provide appropriate solutions, and establish project requirements.

Sign the engagement letter, and complete the intake form seamelessly using our secure client portal equipped with latest technology.

Securely start sharing confidential documents through our encrypted platform for seamless and efficient collaboration.

We carefully review your documents, ensure accuracy, address any issues, and securely deliver your finalized tax files promptly.

Software We Use

Meet Our Expert Team

Kewal Krishan Goyal, FCA

Founder & Board Member

Kewal Krishan Goyal, FCA

Founder & Board Member- Email: kewal@kkca.io

Anshul Goyal, CPA EA FCA

Managing Partner

Anshul Goyal, CPA EA FCA

Managing Partner- Email: anshul@kkca.io

Who We Serve

At Kewal Krishan & Co, we are proud to support a diverse range of clients with tailored tax, accounting, and compliance solutions. Our expertise spans multiple industries, helping businesses and individuals achieve financial success.

H1B, L1, O1 visa holders, Green Card holders & U.S. citizens

U.S. citizens living abroad, foreign investors, non-resident taxpayers

Cross-border tax compliance for individuals & businesses

Non-residents operating U.S. LLCs, corporations, and eCommerce businesses

Freelancers, independent contractors, and digital nomads

U.S. real estate investors, stock traders, crypto investors

Our Credentials

Get a Free, Non-Binding Quote

We're here to help!

Fill out the form below, and our team will respond in less than 24 hours.

- Get personalized support for tax and financial solutions.

- Speak with experienced professionals.

- Fast response within 24 hours.

Contact

Expert Insights and Resources

- admin

- 10 Mar 2026

Selling HDFC Mutual Funds? 2026 Guide for Green Card Holders

- admin

- 10 Mar 2026

F1/J1 Students: Are Your Indian Mutual Funds a Tax Trap in 2026?

- admin

- 09 Mar 2026

Tax Treatment of Indian ELSS Funds Under IRS

- admin

- 09 Mar 2026

IRS Penalties for Not Reporting Indian Mutual Funds

- admin

- 08 Mar 2026

UTI Mutual Funds & US Tax: 2026 IRS Reporting & PFIC Guide

- admin

- 08 Mar 2026